|

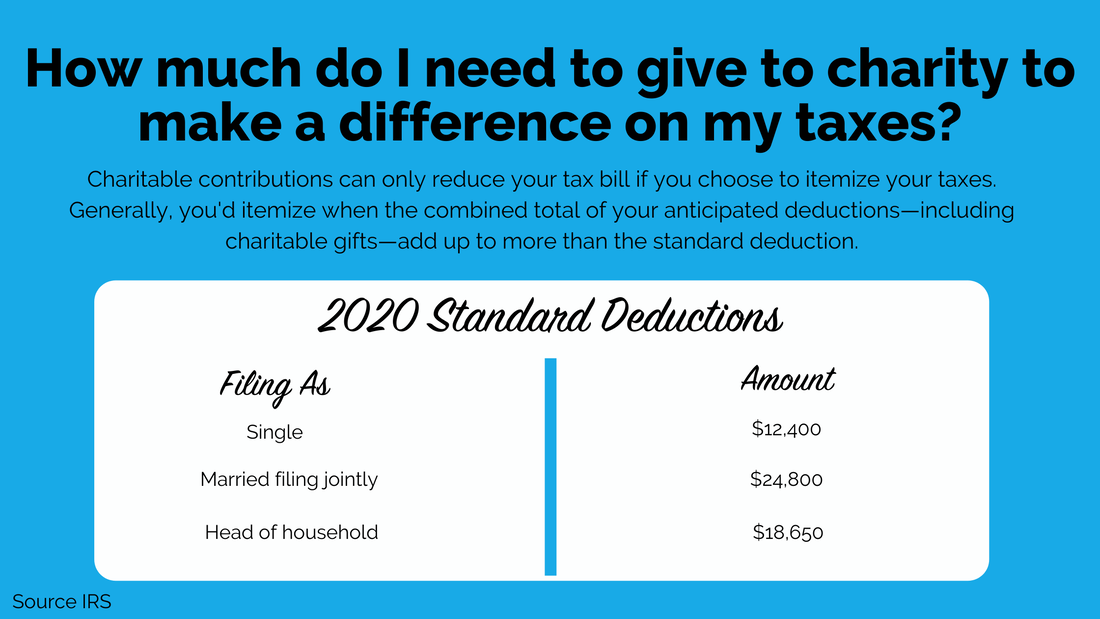

Remind Donors of the CARES Act Tax Deductions for Charitable Giving Giving season is upon us, and nonprofits and social impact organizations have been running lean and nimble amid the Coronavirus pandemic. While annual in-person events have switched to virtual and the outcome of giving season seems unknown and frightening, there is always light at the end of the tunnel. Here is our glass half-full perspective on increasing giving this year: Most donors plan to maintain, or even increase, the amount they donate to charity this year. According to Fidelity Charitable, 25% of donors plan to increase their donations and 54% of donors plan to maintain their giving levels. Younger generations are also upping their giving with 46% of Millennials say they will give more in response to the pandemic. The Coronavirus Aid, Relief and Economic Security (CARES) Act, which includes provisions that are designed to foster charitable giving activities and advance nonprofits’ missions, could incentivize people to give more. Take the time to inform donors about the CARES Act Tax deduction and see if it boosts your giving season results! Here are the deets: Electing individuals who itemize deductions on their personal income tax return (including couples filing a joint return) can deduct qualified cash charitable donations up to 100% of their adjusted gross income (AGI) for tax year 2020.. Under previous law, such contribution deductions were limited to 60% of AGI. That means itemizers can fully deduct their charitable cash contributions this year. Winning! Hopefully this will be a boon to the nonprofit sector and organizations will see a boost in charitable giving. How much do individuals need to give in order to benefit if they want to itemize? For folks who don’t itemize, there’s also a new incentive to give in 2020. If you take the standard deduction on your 2020 tax return (the one that you'll file in 2021), you can claim a brand new "above-the-line" deduction of up to $300 for cash donations to charity.

Be aware, donations to donor advised funds and certain other types of organizations that support charities are not deductible. Also be aware that this deduction is only for those who do NOT itemize (no double dipping, folks). Need help with your tax planning? Have questions on how to frame this for your nonprofit’s donors? Our friendly team at Blue Fox is here to help! Give us a call at (321) 233-3311 or email. We’ll get you sorted!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Our BlogWelcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy! Top ArticlesBack to Basics: How to Set Up Your Nonprofit Chart of Accounts

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits Behind the Scenes, New Client Onboarding Call When to Hire a Tax Professional - 10 Factors to Consider 40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know The Magical Nonprofit Financial Ratio Matrix 10 Reasons to Outsource Your Nonprofit Accounting How to Make Your Nonprofit Recession-Proof How to Engage Your Board of Directors in Financial Conversations QB Tip of the Month: How to Use Classes for Painless Grant Writing When to Hire an Accountant for Your Social Impact Org Are You Paying Too Much for Payroll? Company NewsBlue Fox Teams Up With Bloomerang to Develop Nonprofit Resources

Blue Fox Earns Better Business Bureau Accreditation Blue Fox Launches Protected By Logo Blue Fox - The Origin Story Categories

All

Archives

July 2024

|

BLUE FOX

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

RSS Feed

RSS Feed