If you’re like us, your daily inbox is jam-packed with newsletters and educational opportunities from like-minded social impact leaders. These spectacular humans work around the clock to foster positive change in their communities. Then, somehow, find time to share their story with fellow nonprofit enthusiasts. We tip our hat to them! Here are just a handful of our favorite nonprofit resources this month:

Thanks for stopping by to read our picks for top nonprofit news this month! If you’re interested in hearing more from us, subscribe to our newsletter today! About Blue Fox: Our team provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to comprehensive virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com.

0 Comments

Why Outsource Your Accounting & Back Office? Because You’re a Changemaker, Not a Change Counter!4/23/2019  When it comes to client satisfaction, there’s a phrase we love to hear: “I wish I would have asked for help sooner.” This is our unofficial happiness benchmark and it typically comes during the new client onboarding process. (Often with a huge sigh of relief!) We know that social impact leaders are changemakers first and foremost, with their organization’s mission front and center in all they do. But it can be a struggle to balance your management focus between your mission and your institution. Institutional maintenance (bookkeeping, payroll, budgeting, financial reporting) is critical to sustainability, as we all know. But if these tasks cause #overwhelm, your organization might be a good fit for outsourcing some of them. An outsourced back office doesn’t work for everyone. (Seriously – we tell prospective clients that truth all the time.) How do you know if your organization’s mission and institution can benefit from outsourced services? Consider if any of the following appeals to you:

Outsourcing may not work for you. But Blue Fox is different. We are an accounting firm specifically for nonprofits and social enterprises. Our team members have broad expertise in the social impact space, with backgrounds as nonprofit leaders, board members and volunteers. The entrepreneurial spirit runs deep on our team. This means we manage your back-office from the same perspective as you would. Seriously, read our Philosophy! Now, let’s revisit that huge sigh of relief that comes from outsourcing your back-office. We would love to help you feel that way. Let’s have a chat and see how Blue Fox can help you reach your goals. Call us anytime at (321) 233-3311 or email [email protected].

Cause Camp was recently named by Forbes as one of the Top 10 Nonprofit Conferences. Held at the Nebraska Innovation Campus in Lincoln, Nebraska, it did not disappoint. (Neither did the famed local Hurts Donut or Honest Abe’s Burgers, but that’s a story for another day.) If you don’t want to schlep to Lincoln, you can stream the event for $99. (I did that last year to see if it was worth going. It was. Donuts and burgers notwithstanding.)

Sponsored by Nonprofit Hub, Cause Camp draws about 400 people/year to Lincoln for both lecture-style and breakout sessions. There are parties and lots of local beer, too, but in Lincoln they call that networking so it’s all very legit. My favorite thing about Cause Camp was the intimate size of the crowd and conference space. There were plenty of opportunities to get to know your seat neighbor or lunchmate. And lots of non-structured time allotted for, you know, being human with each other. My second favorite thing about Cause Camp was the speaker lineup. Truly fantastic, engaging, and actionable information presented by every single speaker. And because the crowd was an intimate group, you actually had time and opportunity to chat with the speakers one-on-one. That’s unusual in conference-land. Here’s (just some of) what I learned from the experts at Cause Camp. On Saying Thank You Steve Shattuck from Bloomerang gave a fantastic talk on the importance of thanking donors and thinking about thanking strategically. I think this info applies to for profit entities as well. Thanking the customer is a lost art in modern sales. Check out these stats:

On Donor/Customer Retention Speaker Rachel Muir is my new best friend. She just doesn’t know it yet. (Is that weird? IDK.) A “recovering nonprofit executive,” Rachel is a renowned fundraising consultant. Just a few of the fascinating things Rachel taught us:

On Video Here again, Rachel Muir and others wowed us all. The power of video is undeniable. I’m working on a video content to do list for Blue Fox as we speak. Highlights:

On Finance

Just kidding. As with #19NTC, there were NO sessions on finance. I guess I will just have to apply to speak next year?! This year’s Cause Camp was pretty well focused on storytelling and fundraising, and as you can see it was fantastic content. (I have 11 pages of notes – this blog just scratched the surface.) Maybe that will change in the future. But if not, I think if you do or implement just one of these takeaways from Cause Camp, you will be advancing your mission. My favorite quote from the conference is an old proverb: The knowledge of fire does not keep you warm. How often do we know things and not do them? So get going. Do the things. Try the things. Think about the things. And let us know if we can help. Resources: Speakers and their Twitter feeds teach us a lot. Julia Campbell and Kishshana Palmer’s tweets and Insta posts (Kishshana's) make me either think or LOL almost every day! About: Our team at Blue Fox provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to full-blown virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com. Author: Founder & CEO, the Original Blue Fox, Chantal Sheehan, MS, CFP(r)  Warning: this is a soapbox post. Blue Fox recently sponsored a professional development trip for two nonprofit leaders and clients. (Find out what we all learned here.) We paid all conference fees and airfare, and clients were responsible for food and lodging. (In true nonprofit fashion, we found a reasonably priced Airbnb that would accommodate all three of us and we split the cost.) But an exchange with one of my clients regarding travel expenses totally shocked me (and then became the inspiration for this blog). One executive director sent me a check for her portion of the Airbnb stay – but it came from her personal checking account. I called her to say thanks, but also, you know, WTH? She sounded sheepish as she asked, “You think the organization should pay for it?” “Is this a professional development event we’re going to or are we taking a vacation?” I joked back. “But this travel isn’t in our budget for the year.” (This org is well-funded and always operates under budget thanks to amazing leadership by the ED.) “Has the board approved your attendance at the conference? Are they aware you are going?” Another sheepish, “yes,” escaped her lips. “Then they must understand, as seasoned business people in their own right, that you will not be paying for business expenses personally. There is no way they’d expect you to. But call your Board Chair or Treasurer if you think they’d disagree.” “Really? So what do I do? Submit an expense report?” “Yes, my friend. That’s exactly what you do. And your Treasurer will review and approve it. Simple as that.” “Oh. Okay,” she said quietly. “I didn’t know I could do that.” I shredded her personal check as soon as we hung up the phone and stared out the window for a minute. I didn’t get it. For some reason, this strong, resilient, savvy, professional woman automatically assumed that she was personally liable for her trip expenses. #nonprofitlife, AIR? But as I talked to other nonprofit execs to find out if they had similar questions, I realized that this might be a pattern rather than an anomaly. Could there be a systemic misunderstanding held by nonprofit leadership about what is and is not “okay” when it comes to investments in individuals? How many nonprofit employees spend their own personal funds in service to their organizations – as in, spend their own money just to do their job – with no second thought? This is not okay. Here are some steps you can take to begin professionalizing and changing your organizational approach to investments in individuals.

The social impact space is full of passionate, tireless leaders who put mission first. But the space is also full of tired, stressed out leaders who put themselves dead last. Is that you? Do you invest in tools that will impact and develop your leadership capacity and skills? Do you give yourself permission to allocate time and budget lines for professional development? Do you set positive, healthy examples for your team when it comes to setting boundaries between work and personal life? #nonprofitlife is hard enough. Don’t sell yourself or your team short by failing to invest resources in yourselves. If you’re wondering how to structure things like mileage or expense reimbursement, we can help. Just get in touch: [email protected].  A special note and key learning points from our long-time client, Karen Govern, Executive Director at STARability Foundation: ________________________________________________________________ Thank you so much for the wonderful opportunity to attend the NTEN conference! The learning opportunities were outstanding and each session was useful, interesting and practical. I hope you enjoy just a few of my notes and key learning points below:

I really cannot say enough about my experience at the NTEN conference. The presenters provided access to valuable resources and tools. Although it was a large conference, there was a lot of small “caring” details, such as the helpful attendee packets and wonderful meals and receptions. The app and website were also very helpful for daily planning. And, I truly enjoyed interacting with like-minded leaders to share information, tips, and experiences. I even connected with someone from an organization in Australia that serves individuals with disabilities. We compared our countries’ service delivery systems and discovered we faced similar issues and challenges. _________________________________________________________________________________________________________ The STARability Foundation’s mission is to, “transform the lives of individuals with disabilities through social, vocational and educational connections to the community, while strengthening awareness and respect for individual abilities.” There is no better person to lead these efforts than our long-time client and friend, Karen Govern. She is a truly kind and caring human who leads with thoughtfulness, strategy and focus. We cannot wait to see her continued success and achievements at STARability! We think of our client relationships as true partnerships. Trust, kindness, patience, and respect are forefront of our service delivery and client communications. That’s why our clients, more often than not, also become our friends. Read more about what makes us tick and our five pillars of service. A special note and key learning points from our long-time client, Brenda Brooks, Executive Director at CREW Land & Water Trust:

_______________________________________________________________________________________________________ Many thanks and appreciation go to Blue Fox for providing our nonprofit, the CREW Land & Water Trust, the opportunity to attend the 2019 Nonprofit Technology Conference in Portland, Oregon. The information shared at the conference went above and beyond my expectations of all things tech in the nonprofit sector. The networking opportunities also provided me with connections to help CREW Trust move forward in areas where we’ve encountered obstacles. Here are just 3 of my learning key points:

_______________________________________________________________________________________________________ Brenda works hard to protect and preserve 60,000 acres of Southwest Florida’s critical watershed landscape at CREW. But it’s her passion for education – for people of all ages – on the importance of the watershed to life in Florida that makes us kindreds. Brenda is also an Ironman finisher and avid triathlete. So, you know, she’s an all-around amazing human. We think of our client relationships as true partnerships. Trust, kindness, patience, and respect are forefront of our service delivery and client communications. That’s why our clients, more often than not, also become our friends. Read more about what makes us tick and our five pillars of service. /

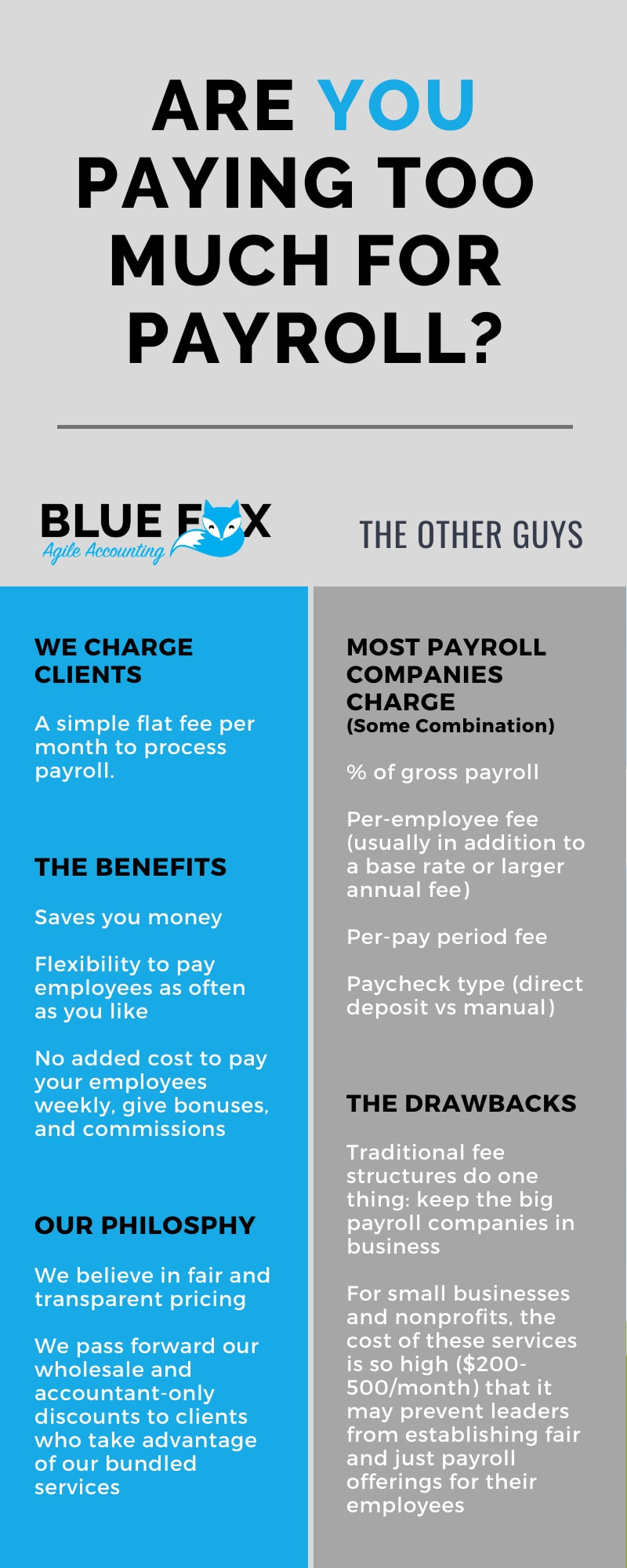

Payroll processing with Blue Fox is 100% different. We charge our clients a simple flat fee per month to process payroll. And, that’s it! ... Blue Fox believes in fair and transparent pricing.

/

We all like getting paid, but is your company paying too much to cut paychecks? There are a boatload of payroll processors out there so it can be hard to figure out the costs involved. Let’s break it down.

Most payroll processing companies charge fees either by:

These fee structures are traditional and are meant to do one thing: keep the big payroll companies in business. But for small businesses and nonprofits, the cost of these services is so high (think $200-500/month) that it may prevent leaders from establishing fair and just payroll offerings for their employees. Weekly pay, bonus payrolls, and even hiring for much needed help may be put on hold by management because of payroll processing fees that creep ever higher... that’s not okay in our book! Payroll processing with Blue Fox is 100% different. We charge our clients a simple flat fee per month to process payroll. And, that’s it! Our payment structure saves your organization money and gives you better flexibility to pay employees as often as you like. You can even pay your employees weekly, give bonuses, and issue commissions at no extra cost. Blue Fox believes in fair and transparent pricing. We receive wholesale and accountant-only discounts on the different platforms we use, and we happily pass those discounts along to clients who take advantage of our bundled services (accounting and payroll, for example). Why? Because that’s the right thing to do and because it just makes sense: if we are your virtual accounting team or CFO, we can run payroll and manage the related bookkeeping seamlessly. It’s a win-win for everyone. Wouldn’t it be nice to rely on one team for all your back-office service needs? Contact us for a quote! P.S. If you're thinking of making a change, please know it's best to change your payroll provider at month-end or quarter-end to avoid payroll tax filing headaches. About: Our team at Blue Fox provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to comprehensive virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com. |

Our BlogWelcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy! Top ArticlesBack to Basics: How to Set Up Your Nonprofit Chart of Accounts

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits Behind the Scenes, New Client Onboarding Call When to Hire a Tax Professional - 10 Factors to Consider 40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know The Magical Nonprofit Financial Ratio Matrix 10 Reasons to Outsource Your Nonprofit Accounting How to Make Your Nonprofit Recession-Proof How to Engage Your Board of Directors in Financial Conversations QB Tip of the Month: How to Use Classes for Painless Grant Writing When to Hire an Accountant for Your Social Impact Org Are You Paying Too Much for Payroll? Company NewsBlue Fox Teams Up With Bloomerang to Develop Nonprofit Resources

Blue Fox Earns Better Business Bureau Accreditation Blue Fox Launches Protected By Logo Blue Fox - The Origin Story Categories

All

Archives

July 2024

|

BLUE FOX

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

RSS Feed

RSS Feed