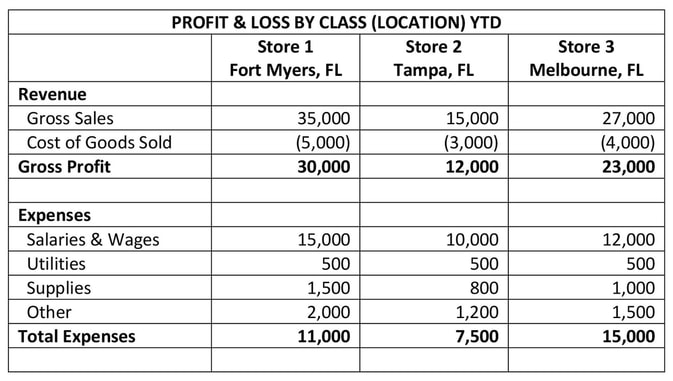

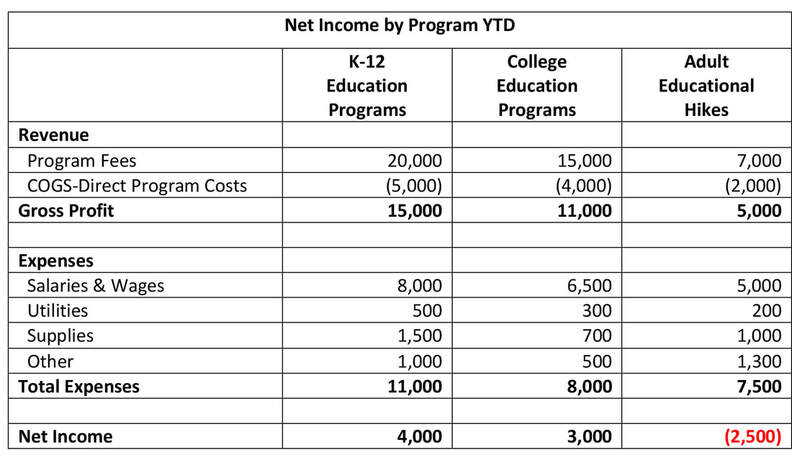

"Getting actionable financial data for grant writing all comes down to the setup of your financial systems." You sit at your computer staring blankly at the screen. You know that you need to finish this grant request, but you’re stuck. The narrative is coming along, but your roadblock is the financial justification for the grant. You open QuickBooks, flip through spreadsheets and you try to interpret the financials from the last month. But your eyes are crossed – you’re just not seeing what you need to make the case. Grant writing is stressful enough without the added burden of working with bad (or at least useless) financial data. If you are a nonprofit executive director or a development professional who’s tasked with writing grant proposals, you’ve probably thought to yourself: there must be a better way. There has to be a better way to set-up QuickBooks for your nonprofit's specific needs! And you’re right. Getting data you need for a grant request all comes down to the setup of your financial systems. Most US-based small to medium-sized nonprofits use some version of QuickBooks for their accounting. It has its quirks, but it’s a solid piece of software. One of our favorite features of QuickBooks is chronically unsung and under-utilized. It’s called CLASSES. Prepare to be wowed and be sure to check out Blue Fox's entire tech-stack that we use to serve our clients. So, what are CLASSES in QuickBooks Online?Well, according to the folks over at Intuit, " Classes represent meaningful segments in your company, like store departments or product lines." Here's a class tracking overview with more details and instructions on how to set up classes and get started. (If you need help, that's what we do at Blue Fox, so give us a shout!) Here's how we describe it: In the for-profit world, classes are often used for cost center or location-based tracking of revenue and expenses. Easy example: a retailer with more than 1 store. The management needs to see what stores are profitable, right? Here’s what a (very simplified) profit and loss report using classes might look like in that case: PROFIT & LOSS BY CLASS (LOCATION) YTD Being able to analyze income and expenses according to location allows management to make better decisions about where to invest staff, time, and money to ensure profitability and sustainability. Brilliantly, this same classes tool in QuickBooks can be used to track a nonprofit program revenue and expenses. (Can you feel the excitement building?? #nerdalert) Using this method, you can allocate a percentage of staff salaries, general overhead, and direct program costs to each program WITHOUT adding a gazillion lines to your Chart of Accounts. Here’s what that might look like for an environmental education nonprofit: Now, that's a 'QuickBooks for nonprofits' application we can get excited about! Please allow us to elaborate!Do you see the leverage and empowerment that comes with this kind of accounting setup? If you were writing a grant for this organization’s adult programs, you’d be able to easily make the case for shortfall and demonstrate the need, right? On the other hand, if you were writing a grant for the expansion of your K-12 programs, you could evaluate the estimated cost of that expanded reach based on the annual spend in that class. Once you have your accounting system set up in this way, you can budget by class, run regular reports by class, and get valuable insights as to what is/is not sustainable from a revenue perspective. This not only assists with grant writing, but it will also lead you to have deeper and more honest conversations about things like program fees, fundraising goals and campaigns, and program budgets. Bonus Read: Meet One of The Most High-Functioning, Financially Sustainable Nonprofit Organizations We Know: STARability Foundation (You guessed it, organizing this clients QuickBooks class structure was part of their transformation). By the way, we love our clients!! How game-changing would this type of reporting be for you? Imagine the possibilities. A couple of caveats and words of caution:

Does it sound like we know our stuff? We do! The Blue Fox team will help get those financials in order and make grant writing a breeze! Is your organization ready to outsource your accounting function? Here’s how you know when. Have you considered the benefits? Here are 10 of the most important reasons. If anything, let’s review your chart of accounts and class set up. We can start the conversation with a free consultation! Editors Note: This post was originally published in July 2019 and has been completely revamped and updated for accuracy and comprehensiveness. Here are some other articles you might enjoy reading:

QuickBooks Online Is Implementing Usage Limits WHAT YOU NEED TO KNOW Key Takeaways [and Great Resources] From QuickBooks Connect 2020 Conference How Small Businesses Can Stay Afloat (and Grow) During Uncertainty

0 Comments

If you’re unfamiliar with the concept, Virtual CFO's may be called outsourced, part-time, or fractional CFOs. Nonprofit trend alert: Enter the virtual CFO (that's us, meet our team)! Chief Financial Officer. Head Honcho of All the Numbers. If you’ve ever met one, your mental picture of a traditional CFO is likely one of a middle-aged white guy wearing glasses, khakis, and a button down shirt hunched over a computer with paperwork all over his desk. Let’s call him Bob. We’re happy to report that, while Bob lives on in many businesses, a growing trend in finance that's disrupting the C-suite for good. Enter the outsourced, virtual CFO, or vCFO. Virtual or in-office, here's what to look for in a nonprofit CFO. If you’re unfamiliar with the concept, vCFOs may be called outsourced, part-time, or fractional CFOs. Google those terms and be amazed at the number of results. We think that 2022 will be another banner year for outsourced CFOs everywhere, so we thought it might be time to break it down for you. [Bonus read: 10 Reasons to Outsource Your Nonprofit Accounting] Here’s what you need to know: (1) WHO Virtual CFO's may either be a firm or an individual. Usually they are CPAs, senior accountants or bookkeepers, or other experienced and educated individuals who’ve held CFO or senior finance or accounting roles in the past. Likely female (more than half of all accountants in the US are women), these folks are highly skilled numbers nerds who can fill the CFO role just as well as (better than?) Bob. (2) WHAT What does an outsourced CFO do? They may be charged with a variety of tasks including bookkeeping, accounting, month-end closes, payroll, and financial reporting. But the real leverage in a Virtual CFO is the strategic guidance and financial planning she provides. Interpreting financial data in a way that makes sense to other members of the C-suite is job #1. The rest of the job is to take a proactive approach to finance with sustainability in mind. A vCFO helps organizations streamline its financial systems and processes, develop strategic budgets, manage financial risk, raise capital, and figure out exactly what is needed to get from where your business or nonprofit is today to where you would like it to go. (3) WHY A growing number of nonprofits (like our Fox-tastic clients) turn to vCFOs for these reasons:

(4) WHEN When to hire a vCFO is something we covered in this blog, but a different type of when question we get about Blue Fox is: when can we call you? The answer is: anytime. One big bonus of a vCFO is that, in most cases, they are available to support you, ask questions, present at meetings, and generally do whatever you need them to do anytime. 100% uptime, to poach a tech industry phrase. That’s because vCFO firms like ours pair a bookkeeper and a senior accountant on each client’s work. You can always reach someone on your virtual finance team and you’re never left in the lurch. Again, our singular agenda is: support you and your organization to the best of our ability at all times. (5) WHERE & HOW This is an easy one – outsourced CFOs can be remote and tend to deliver their services through cloud-based technology. It’s actually the recent evolutions in cloud-based accounting tech that make what we do possible – 10 years ago, the tech just wasn’t there. But now we can work with any client anywhere at any time. As a vCFO client, that also means you can pick from the nation’s top service providers, rather than just your local market. You can source vCFOs who specialize in your industry, and they can work for you from anywhere. Video and conference calls bridge the communications gaps, and our cloud-based tools allow us to securely exchange data and provide live, real-time accounting information all day long. Hopefully, now you can see why one the hottest business trends will continue to be the rise of the virtual CFO. Will your nonprofit be an early adopter? Our Team at Blue Fox Can Assist You Today!Whether your nonprofit is seeking a full-service Virtual CFO or basic accounting services (we also offer payroll, tax and consulting), our team of nonprofit gurus at Blue Fox are ready to assist you! We serve our clients with exactly the right mix of services to support their back office operations. And guess what?! We were recognized among the Top 5 Accounting Firms In Florida in 2021 by DesignRush. What does your organization need help with? Editors Note: This post was originally published in December 2019 and has been completely revamped and updated for accuracy and comprehensiveness. Here are some other articles you might enjoy reading:

10 Reasons to Outsource Your Nonprofit Accounting Why Should My Nonprofit Outsource Its Accounting? When to Hire an Accountant For Your Social Impact Organization |

Our BlogWelcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy! Top ArticlesBack to Basics: How to Set Up Your Nonprofit Chart of Accounts

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits Behind the Scenes, New Client Onboarding Call When to Hire a Tax Professional - 10 Factors to Consider 40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know The Magical Nonprofit Financial Ratio Matrix 10 Reasons to Outsource Your Nonprofit Accounting How to Make Your Nonprofit Recession-Proof How to Engage Your Board of Directors in Financial Conversations QB Tip of the Month: How to Use Classes for Painless Grant Writing When to Hire an Accountant for Your Social Impact Org Are You Paying Too Much for Payroll? Company NewsBlue Fox Teams Up With Bloomerang to Develop Nonprofit Resources

Blue Fox Earns Better Business Bureau Accreditation Blue Fox Launches Protected By Logo Blue Fox - The Origin Story Categories

All

Archives

July 2024

|

BLUE FOX

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

RSS Feed

RSS Feed