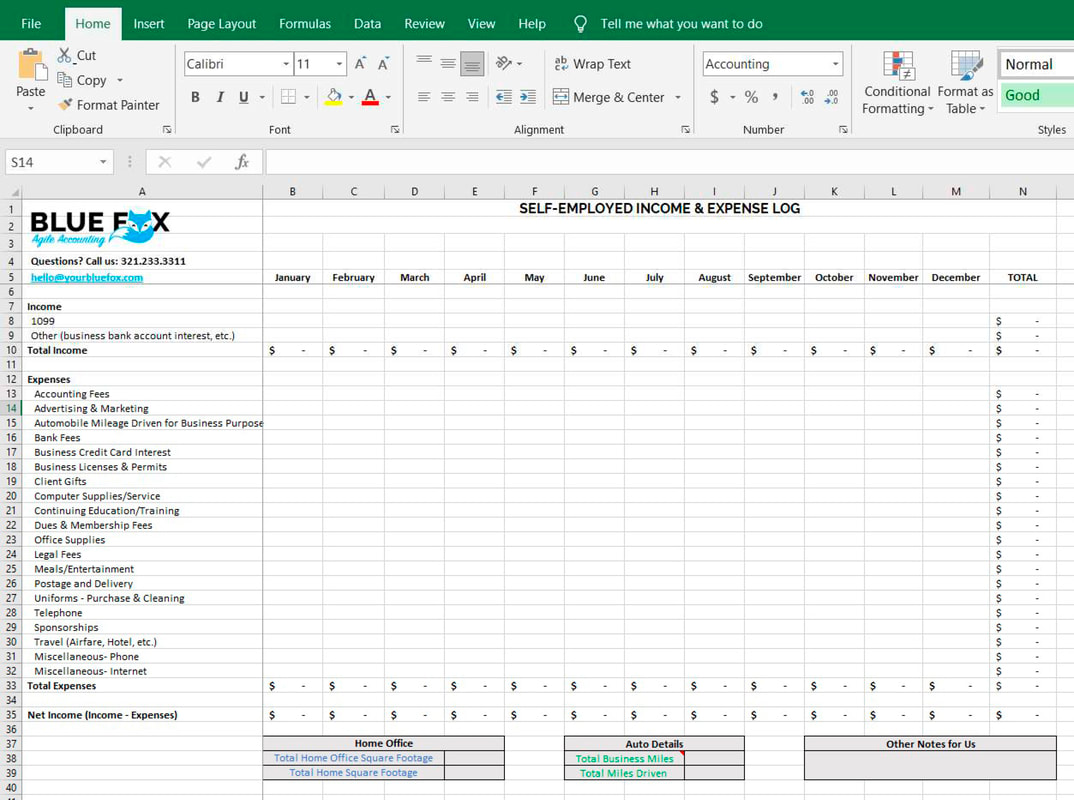

The Best Way to Track Income & Expenses for Tax Form 1040 Sole proprietors: get out your shoebox of 2022 receipts and let’s get organized. Our team at Blue Fox created this handy Schedule C Worksheet for your profit or loss record-keeping pleasure. If you’re wondering how to fill out the Schedule C Form 1040, this easy-to-use tool will get your financial ducks in a row. We highly recommend using it before you attempt the official IRS form. You may also download the 2023 Schedule C Worksheet and record your 2023 income and expenses as the year progresses.

0 Comments

Raise your hand if you love being audited. Anyone? Anyone? We didn’t think so. At most companies, audit time causes anxiety and panic. And, the pressure doesn’t stop there. As a financial services and advisory firm, we’re under the microscope too. For many nonprofit organizations an audit is an annual occurrence (often mandated in the bylaws or by state law). From a fundraising perspective, a clean audit can demonstrate sound financial stewardship and pave the way for increased donor trust and giving. That’s why our team at Blue Fox views a client audit as a management and marketing opportunity, as well as an important financial management exercise. Using the right tools and technology, we’ve reduced the tedious audit process from an average 10 hours down to just 2. That’s an entire workday saved – you’re welcome! How did we do it? One app: Bill.com. We’re such big fans of Bill.com’s audit effectiveness that Bill.com asked our CEO, Chantal Sheehan to write about it on their blog. In the full article, How to Help Your Clients Get a Clean Audit, she highlights 3 key features at Bill.com that help our clients get clean, fairly painless audits each year: (1) Digitized, paperless records (2) Enforcement of internal controls (3) Audit trail feature The full article gives specific details and examples. It’s a must read! Is your organization looking for nonprofit audit preparation services? Give us a call at (321) 233-3311 or request a meeting. We’ll get you sorted! Then you can focus on what really matters: your mission and serving your community. Related Articles 5 Tips to Get You A Clean Audit Every Year Nonprofits - It's Time to Automate Your Back Office 10 Reasons to Outsource Your Nonprofit Accounting  As usual, at the end of 2018 the IRS revised the mileage reimbursement rates for business, charitable, and medical/moving miles driven. The new rates are as follows for 2019:

Ever wonder: what goes into those rate changes? Is there just a dude sitting at Treasury somewhere who makes the call, or is there a formula of some kind in place? As satisfying as it might be to blame an unknown dude at Treasury, it turns out there are a few known factors that go into the mileage rate calculation:

Generally, when the costs above go up, we see an increase in the mileage rate. And when they go down, we see a decrease. As a consumer, though, it often feels to me like the best indicator that there will be an increase is gas prices. (If you want to geek out and compare historic fuel prices with historic mileage rates, have at it. We did!) In 2019, gas prices are expected to continue to rise so the IRS has provided a 3.5 cent bump to the business mileage rate. (Woohoo! Don’t spend it all in one place!) If you use an app like Expensify, MileIQ, or Motus to track your business miles, the apps should compute your mileage reimbursement correctly. If you’re old school and using a paper expense report to get mileage reimbursement from your employer, or to track your own business mileage deduction, then you’ll want to correct all your expense report formulas and forms to reflect the new rate. And stay tuned: word on the street is that there might be a 2nd mileage rate hike mid-year if gas prices aggressively rise this year. About: Our team at Blue Fox provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to full-blown virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com. Author: Founder & CEO, the Original Blue Fox, Chantal Sheehan, MS, CFP(r) Earth Mother & Proud Tree Hugger: Why We’re on a Mission to Help Conservation Organizations11/30/2018  Just about 10 years ago, I was brought to a dinner party by a good friend. By way of introduction, my friend announced that I was visiting from Vermont where I was in grad school. Someone said, “Grad school in Vermont? With all the hippies up there?” My friend replied, “Yep, she’s a Tree Hugger!” I remember bristling at the time, both because I worried the crowd wouldn’t respond well to the Tree Hugger label, and also because I never really thought of myself that way. (Truth be told, I bristle at pretty much any label applied to people – labels are for food and packages. Not for humans.) But I realized later that being called a Tree Hugger was actually a critical moment for me. From that point on, I started to embrace my innate passion for nature, conservation, ecology, and protection of our natural resources. When I was a little kid, I was outside as much as I could be, especially after we moved from my birthplace of New York to North Carolina (mountains!) and then later to Florida (beach and climbing oak trees!). I was one of those kids who always came home filthy and was sent straight to the bath. I used to run around the woods by our house barefoot, delighting in the feel of grass and earth between my toes. I played outside in the rain constantly and stared out the living room window whenever a thunderstorm put on a lightning show for, in my mind, my own viewing pleasure. My parents brought me up with a keen sense of respect for and love of all that nature has to provide. As I grew up, one of the only clubs at school I joined and actually liked was the Ecology Club. We studied the weather and hosted coastal cleanups around the Tampa Bay area, where I made collecting trash on the beach into a competitive sport. I suppose that deep down it just always made sense to me that we should be the guardians and stewards of our Mother Earth – that if we fail, we will ultimately become extinct, or at the very least, homeless. The fact that so many of my fellow Earth-dwellers simply do not accept their responsibility as caretakers and stewards of the planet drives me absolutely nuts. With all the data and scientific tools we have today, we know – we KNOW – that we are:

Needless to say, I continue to be a passionate advocate for the work done by conservation and environmental education organizations around the country, but especially at home here in Florida. As Den Mother at Blue Fox, I proudly support a focus on service to nonprofits and social enterprises that operate in these arenas. From electronic recyclers to conservation organizations to environmental engineers, each of these Blue Fox clients play a critical role in safeguarding and protecting our natural resources. We are honored to serve them and help magnify their impact in a small but meaningful way. If you’re considering making a charitable donation this holiday season, please: send some (or all!) of your dollars to a nonprofit that you trust to make an environmental impact. The global focus on environmental improvements since the first Earth Day in 1970 are impressive! We can accomplish big, great things when we put our political and financial will to work for a cause. I am a Tree Hugger – there’s no denying it. Question is: are you? ____________________________________________________________________________________ Author: Founder & CEO, the Original Blue Fox, Chantal Sheehan, MS, CFP(r) Company Info: Our team at Blue Fox provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to full-blown virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com. FOR IMMEDIATE RELEASE With Balance Announces Rebrand to Blue Fox The new brand reflects the company’s unique feel along with its commitment to innovation, technology, and giving back MELBOURNE, Florida — September 3, 2018 — With Balance, boutique virtual bookkeeping and financial consulting firm serving nonprofits and social enterprises nationally, today announced a rebrand to Blue Fox. The comprehensive rebrand provides a fresh and distinct framework for differentiation in the accounting and back office space, and includes a new logo, positioning, and website.

Blue Fox’s unique blend of a technology-based, best of breed bookkeeping solution platform and its laser focus on high quality service and friendly human touch make it an essential and invaluable partner to the nonprofit executive or small business owner. Blue Fox virtual services range from basic accounting to full service CFO-ship. Other back office support includes payroll, tax preparation, and consulting. The company will continue to invest in the cloud-based financial technology (check out our nonprofit accounting tech-stack) that nonprofits and social enterprises need to grow while providing expert support and superior, cheerful hands on assistance. As evidence of its unique culture and commitment to providing real value added to the social impact space, the company also announced the launch of the Blue Fox Foundation, a registered 501(c)(3) charitable organization. The foundation’s mission is to ensure the vitality and financial sustainability of the social sector. “We are excited to publicly commit to actively improving the financial health of the social sector,” says Foundation and Blue Fox founder and CEO, Chantal Sheehan. “Our promise to donate 10% of all corporate proceeds to the Blue Fox Foundation is just the beginning. We hope to inspire gifts from our clients, other foundations, and the public to increase investment in nonprofit technology and training, specifically as it relates to fiscal well-being. The sector simply doesn’t emphasize the importance of this aspect of operations and we are passionately dedicated to changing that. As the saying goes, no money, no mission.” With the rebrand and foundation launch, Blue Fox further stands out as an up and coming leader, not only within the accounting and back office industry but also within the broader Space Coast and Florida ecosystems. Its new logo brings a sharp, fresh new visual identity, and characterizes the brand as bold, clever, wise, and a little playful. These are not the traits of the typical accounting firm, and that’s exactly the point. Please visit www.yourbluefox.com to explore the new Blue Fox website and learn more about the services it offers. For further inquiries, please email: [email protected] or call: 321-233-3311. |

Our BlogWelcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy! Top ArticlesBack to Basics: How to Set Up Your Nonprofit Chart of Accounts

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits Behind the Scenes, New Client Onboarding Call When to Hire a Tax Professional - 10 Factors to Consider 40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know The Magical Nonprofit Financial Ratio Matrix 10 Reasons to Outsource Your Nonprofit Accounting How to Make Your Nonprofit Recession-Proof How to Engage Your Board of Directors in Financial Conversations QB Tip of the Month: How to Use Classes for Painless Grant Writing When to Hire an Accountant for Your Social Impact Org Are You Paying Too Much for Payroll? Company NewsBlue Fox Teams Up With Bloomerang to Develop Nonprofit Resources

Blue Fox Earns Better Business Bureau Accreditation Blue Fox Launches Protected By Logo Blue Fox - The Origin Story Categories

All

Archives

July 2024

|

BLUE FOX

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

RSS Feed

RSS Feed