|

FOR IMMEDIATE RELEASE BLUE FOX NAMED A NATIONAL TOP 50 |

| Melbourne, FL (June 30, 2024) – Blue Fox was recently named a 2024 Top 50 Accounting Services Practice by Woodard, one of the nation's largest consortium of accounting firms. The Blue Fox team was recognized as a member of this elite nationwide group of accounting professionals during Woodard’s Scaling New Heights Conference in Orlando in June 2024. Designed to honor and celebrate exceptional accounting services practices, the award spotlights practices that best embody the characteristics of top-tier performance—intentionality, specialization, efficiency, effectiveness, profitability, and scalability. |

“This award signals a new level of honor and achievement for our team. We are delighted and humbled to be named a Top 50 Accounting Practice nationally. We appreciate the recognition from Woodard and its selection committee, and we look forward to continuing to learn from our fellow awardees and members of the Woodard community as we continue to grow,” says Blue Fox Founder and CEO, Chantal Sheehan.

When asked what she attributes the company’s success to, Sheehan says, “Everyone defines success differently. At the end of the day, at Blue Fox, we say only 2 things really matter: our team members being happy and fulfilled, and our clients being happy and stress-free. We’ve carefully and intentionally constructed our staffing model, our systems, and our company culture to align with our values. This laser focus on what matters to us, along with our holistic approach to client service, is what makes us unique and successful.”

Blue Fox is one year away from celebrating its 10th anniversary. Since its inception in 2015, the company has experienced significant growth in both its client base and the depth of services it provides to social impact organizations (nonprofits and social enterprises). Approaching a decade in business, the Blue Fox leadership team continues to strategize about ways to magnify the company’s impact and improve the accounting service model for the good of all.

Sheehan elaborates on the company’s future mindset, “Our just cause, or long-term vision, is to create a world where every business and nonprofit leader feels informed and empowered to make decisions that will create positive change in their employees' and stakeholders’ lives. We believe that the best way to do this is to democratize access to the strategies that make businesses impactful, successful, and profitable. We have some exciting plans in place that will help us do that, and we look forward to sharing them publicly soon!”

To learn more about Blue Fox, visit www.yourbluefox.com.

To learn more about Woodard’s Top 50 Accounting Services Practice Awards, visit www.woodard.com/top-50-accounting-services-practice.

###

ABOUT BLUE FOX: Blue Fox provides customized financial and back-office services for social impact organizations (nonprofits and social enterprises). The company’s services include bookkeeping, payroll, tax preparation, financial consulting, and comprehensive virtual CFO services. Blue Fox aims to be the game-changer and difference-maker for every changemaker so that, together, we can make the world a happier, healthier, and better place for all. For more information, call (321) 233-3311, email [email protected], and visit www.yourbluefox.com.

[It’s No Secret; It’s Our Clients!]

We forget that our work enables our clients to maximize their impact. There is a direct correlation between sound financial management and the ability of a nonprofit to provide broader and more in-depth services. This client case study proves it!

Our clients are change-makers for good. They provide services and advocacy for underserved and unheard populations. They protect the rights of animals and ensure sustainable food production practices. They work to improve and make more equitable the planet we call home. Can we talk about that as a motivating factor?

In addition to meetings and team bonding, we visited two long-term clients: STARability Foundation, including their STAR Store & Studio, and the Flint Pen Strand Trail, preserved and managed by CREW Land & Water Trust.

STARability Foundation Tour

Driving to our next stop, STARability’s headquarters also in Naples, our CEO reminded us that our financial guidance helped the board and staff decide to open the STAR Store in 2021, and later that year, we also helped them ensure product profitability through some financial modeling and analysis. This year, STARability hopes to kick it up a notch with its store and studio, deepening its financial sustainability through its social enterprises. Again, we’ll be on deck to provide growth and revenue model support. This is our ripple effect in full force.

Corkscrew Regional Ecosystem Watershed Tour

CREW stands for Corkscrew Regional Ecosystem Watershed and is responsible for preserving the largest intact watershed in Southwest Florida. We’re talking about 60,000 acres of land that purifies drinking water, prevents homes from flooding, provides habitat for local wildlife, and offers a beautiful space for public recreation. CREW’s existence is essential to the future sustainability of Southwest Florida and, more broadly, the lower half of Florida. Guess who does their accounting? It’s us, and we are proud of it!

As we walked with our families on CREW’s newest trail, the Flint Pen Strand Trail, we took in the peacefulness of the surrounding land. Birds chirped, the sky was blue, and Florida slash pines stood high all around us. CREW’s Executive Director, Bob Lucius, gave us a bona fide guided hike and taught us all about the importance of preserving Southwest Florida’s watershed. Water is life.

Our CEO, Chantal described the day like this, “I’ve been coming to CREW for 10 years, and every time I do, I feel a sense of calm and peace come over me. We’re so lucky to have this special place to hike, walk, explore, and experience nature. Helping CREW protect Florida’s natural resources makes us all feel like our work makes a difference to people and the planet.”

It’s our client’s work that inspires us.

Our work may seem like “just accounting” some days, but our approach helps clients drive deeper impact every day.

Queue more goosebumps.

We invite you to meet our clients, our team, and learn more about our philosophy at Blue Fox. And if you know of any social-minded number crunchers looking for the perfect place to hone their financial talents, please send them our way!

Blue Fox CEO Chantal Sheehan Joins Equality Florida’s Equality Means Business Advisory Council

6/8/2023

READ: Her Statement on the Importance of Diversity and Inclusion in the Workplace

Equality Florida is the largest civil rights organization in Florida dedicated to securing full equality for Florida’s LGBT community. One of the organization’s focuses is to improve Florida’s national and international reputation as an inclusive place to live, work, and visit. To meet their goal, they established Equality Means Business. This program spotlights employers in Florida that have adopted comprehensive

non-discrimination policies and demonstrated their commitment to valuing and proactively including all employees.

For her council application, Chantal was asked to write a statement about the importance of diversity and inclusion in the workplace. Here is what she wrote:

| “Whether or not we realize (or accept) it, the concepts of equity and inclusion are relevant to everyone. DEI work is about recognizing that our unique individual circumstances factor into our ability to succeed. True equality cannot be attained without addressing any limiting factors within those circumstances. Over 15 years ago, I learned about the DEI framework in my master’s program at SIT Graduate Institute. It was personally and professionally transformational to unpack my social identity and study the concepts of privilege. It was also crazy hard work. But advancing equity and inclusion in our community demands courage and an individual commitment to that work. Change starts within. |

DEI is about creating an on-ramp to success for every individual, regardless of circumstance. I strongly believe every leader has a moral and spiritual obligation to have an inclusive mindset. Beyond that imperative, though, study after study shows that companies and communities that embrace inclusion see dramatic increases in innovation, worker satisfaction and retention, growth, and profits. As a business and community leader, and as a human who cares about other humans, commitment to equity and inclusivity is quite simply the best investment in my community that I could ever make.”

Open Doors Florida is a mobile-friendly statewide business directory that spotlights merchants, faith organizations, and other companies that have implemented LGBTQ-inclusive nondiscrimination in their policies and practices of running their businesses.

Our team encourages you to browse the directory and work with these businesses and business owners that embrace belonging, fairness, and equal opportunity for their employees and customers!

We look forward to a time when we don’t need a directory to help us provide equity to all humans. To get there, we must all do our part and continue to break down barriers to inclusion in whatever ways we can.

An Update on Silicon Valley Bank: Steps you can take to protect your business in this environment

We strongly advise all Blue Fox clients, subscribers, and friends to ensure that the balance held at your bank(s) is at or below the FDIC-insured limits. The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

Steps to Protect Your Business!

Even if you do not bank with SVB, here are some things for you to think about. Some of these may be seen as general best practices, but they also reflect what we’ve learned as we’ve helped impacted customers navigate the current SVB situation.

- Have Multiple Banking Partners - If you only have one corporate banking partner, consider opening a second account with another bank as a redundancy for funding critical operations before you need it. Businesses with a backup account with another institution are able to fund their next payroll and create certainty for their teams.

- Establish Sources of Emergency Funding - If you have investors, speak to them about the SVB situation. If a similar situation were to happen to your banking partner(s), talk about the role these investors might be able to play in helping you to bridge payroll to get to the other side. Again, this is something that companies impacted by the SVB situation are working through in real-time. The SVB situation happened extremely fast and having an emergency funding plan in place creates certainty for you and your business.

- Communicate - In any situation impacting payroll, the stress can be high. Have a communications plan ready for your employees. Communicate early, often, and honestly. Let people know what is going on. Even if you miss the employee pay date—you can process off cycle once you gain access to funds. Remember there’s still an obligation to pay your employees in a timely manner—certain states may impose penalties on your company for late wage payments.

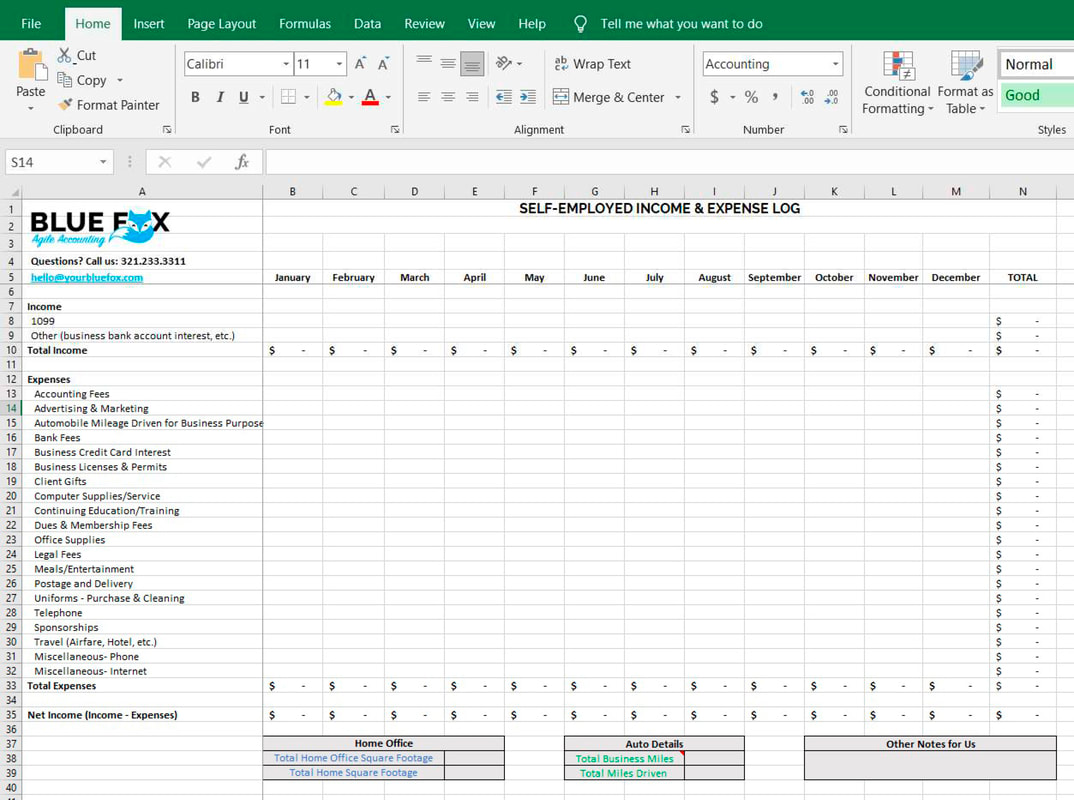

The Best Way to Track Income & Expenses for Tax Form 1040

| And, if you’re like our other tax clients (yes, we specialize in tax preparation for the self-employed), you can send the completed worksheet to us and let us handle the IRS filing process. Give us a call at (321) 233-3311, set up a meeting, or email [email protected]. Last but not least: if you’re revenue is greater than $30k, there may be tax benefits of incorporating. Let us help you analyze the numbers and see if it's worth it. [READ: Is it Time to Incorporate My Side Hustle? Let’s Crunch Those Numbers] |

According to an article by CNBC, Supreme Court again declines to block Biden’s student loan relief plan, "Justice Amy Coney Barrett denied an emergency application brought by the Pacific Legal Foundation to block federal student loan forgiveness... For now, student loan forgiveness remains on hold from a separate challenge brought by six GOP-led states after an appeals court judge in the 8th Circuit granted a stay...Close to 26 million Americans have already applied for student loan forgiveness."

According to this article by CNN, "A federal appeals court put a temporary, administrative hold on President Joe Biden’s student loan forgiveness program, barring the administration from canceling loans covered under the policy, while the court considers a challenge to it." The U.S Department of Education's application portal says that they will be reviewing applications during this pause so that they are ready to begin processing debt relief once the court cases are resolved.

How to Apply for Federal Student Loan Debt Relief

- Borrowers can access the application here: studentaid.gov/debtrelief/apply.

- The application process takes about 5 minutes.

- Applicants do not need to create a login or provide any documents to apply.

- The U.S. Department of Education will reach out directly to applicants if they need to provide additional information. Emails to borrowers will come from [email protected], [email protected], or [email protected]. Scam attempts can be reported to the Federal Trade Commission by calling 1-877-382-4357 or by visiting reportfraud.ftc.gov.

- A paper application will be available soon.

- The application is available in both English and Spanish

Who is Eligible for Student Loan Debt Relief

- The debt relief applies only to loan balances you had before June 30, 2022. Any new loans disbursed on or after July 1, 2022, aren’t eligible for debt relief.

- Here is the full list of the loans that are eligible.

- The application states, "To be eligible, you must affirm that ONE of the following is true for 2020 (Jan. 1–Dec. 31, 2020) or 2021 (Jan. 1–Dec. 31, 2021):

- I made less than the required income to file federal taxes.

- I filed as a single tax-filer AND made less than $125,000.

- I was married, filed my taxes separately, AND made less than $125,000.

- I was married, filed my taxes jointly, AND made less than $250,000.

- I filed as a head of household AND made less than $250,000.

- I filed as a qualifying widow(er) AND made less than $250,000."

- To confirm which loans you have, log in to StudentAid.gov and select “My Aid” in the dropdown menu under your name at the top right of your screen.

Beware of Student Loan Debt Relief SCAMS!

Please read this message from the U.S Department of Education:

"Here's a list of Do's and Don'ts to protect yourself against scams as you prepare to apply for debt relief.

- DON'T pay anyone who contacts you with promises of debt relief or loan forgiveness. You will not need to pay anyone to obtain debt relief. The application will be free and easy to use.

- DON'T reveal your FSA ID or account information or password to anyone who contacts you. The Department of Education and your federal student loan servicer will never call or email you asking for this information.

- DON'T ever give personal or financial information to an unfamiliar caller. When in doubt, hang up and call your student loan servicer directly. You can find your federal student loan servicer's contact information at Studentaid.gov/manage-loans/repayment/servicers.

- DON'T refinance your federal student loans unless you know the risks. If you refinance federal student loans eligible for debt relief into a private loan, you will lose out on important benefits like one-time debt relief and flexible payment plans for federal loans.

- DO create an FSA ID at StudentAid.gov. You will not need it for the debt relief application but having an FSA ID can allow you to easily access accurate information on your loan and make sure FSA can contact you directly, helping you equip yourself against scammers trying to contact you. Log in to your current account on StudentAid.gov and keep your contact info up to date. If you need help logging in follow these tips on accessing your account.

- DO make sure your loan servicer has your most current contact information. If you don't know who your servicer is, you can log into StudentAid.gov and see your servicer(s) in your account.

- DO share these messages with your networks and encourage others to sign up at www.ed.gov/subscriptions to be notified when the Student Loan Debt Relief application becomes available.

- DO report scammers to the Federal Trade Commission by visiting reportfraud.ftc.gov."

We stand with our team and our community to do whatever we can to help.

If you are looking for ways to aid recovery efforts, please see the list below that includes organizations that are making a direct impact in SWFL (the boots on the ground). If you have time, talent, or treasure to contribute, please do!

We’ve also included some resources to help those affected stay connected and updated

How to Support, Give, and Connect

- American Red Cross - Hurricane Ian Relief | redcross.org

- Center for Disaster Philanthropy’s 2022 Hurricane Season Fund | disasterphilanthropy.org

- Good360 - Short and Long-Term Relief | good360.org

- Official Florida Disaster Fund | volunteerflorida.org

- World Central Kitchen | wck.org

- A Florida Homeowner’s Guide: Property Tax Relief for Hurricanes Ian and Nicole I download here

Southwest Florida (Boots On the Ground)

- American Red Cross (Florida Gulf Coast to Heartland) | redcross.org

- Collier Community Foundation | colliercf.org

- Community Cooperative | communitycooperative.com

- F.I.S.H. (Friends in Service Here) | fishofsancap.org

- Florida Disaster Fund | volunteerflorida.org

- Fort Myers Beach Community Foundation | fmbcommunityfoundation.com

- Habitat for Humanity of Lee and Hendry Counties | habitat4humanity.org

- Harry Chapin Food Bank of Southwest Florida | harrychapinfoodbank.org

- Lee County Homeless Coalition | leehomeless.org

- Sanibel-Captiva Conservation Foundation | sccf.org

- SWFL Emergency Relief Fund through Collaboratory | collaboratory.org

- SWFL Inc. | swflinc.com

- Valerie’s House | valerieshouse.org

Volunteer Opportunities

Volunteer Florida is the state’s lead agency for volunteerism and national service. This organization has compiled a variety of opportunities through its Volunteer Connect platform. Click here to find ways to volunteer and assist those in need from the devastation of Hurricane Ian.

Hurricane Ian Direct Impact Assistance

FEMA

Thousands of FEMA and federal personnel are working alongside Florida National Guard and other state response and emergency managers to support recovery from Ian. Here is more information on how FEMA continues to respond to Hurricane Ian.

Apply for Disaster Assistance

If you have been affected by Hurricane Ian in Florida, apply for assistance at www.disasterassistance.gov or call 800-621-3362.

Call the FL SAIL - State Assistance Information Line - for up-to-date information on state assistance at 800-342-3557.

Small Business Administration Disaster Support for Businesses in Affected Areas | disasterloanassistance.sba.gov

Disaster Distress Hotline

Mental health resources are available. Survivors experiencing emotional distress can call or text the Disaster Distress Helpline at 800-985-5990. The national hotline provides free 24/7, crisis counseling for people who are experiencing emotional distress related to any natural or human-caused disaster. Deaf and hard of hearing ASL callers can use a videophone or ASL Now.

Unemployment Aid

State and federal officials have made it easier for storm victims to apply for unemployment aid. Work search reporting, waiting week and registration requirements for Reemployment Assistance claims have been temporarily waived in the counties declared disasters.

Updates & Information

Stay up-to-date on announcements by accessing government and public safety organizations at the county and state levels (this list may not be exhaustive):

County Offices

Brevard | brevardfl.gov

Charlotte | charlottecountyfl.gov

Collier | colliercountyfl.gov

Duval | coj.net

Flagler | flaglercounty.gov

Hillsborough | hillsboroughcounty.org

Lake | lakecountyfl.gov

Lee | leegov.com

Manatee | manatee.hosted.civiclive.com

Monroe | monroecounty-fl.gov

Nassau | nassaucountyfl.com

Orange | orangecountyfl.net

Osceola | osceola.org

Pasco | pascocountyfl.net

Pinellas | pinellascounty.org

Polk | polk-county.net

Sarasota | scgov.net

St. Johns | co.st-johns.fl.us

Seminole | seminolecountyfl.gov

Sumter | sumtercountyfl.gov

Volusia | volusia.org

State Offices

Official Florida State Website | myflorida.com

Florida Division of Emergency Management | floridadisaster.org

Power Outages

State of Florida Power Outages | floridadisaster.maps.arcgis.com

Support Blue Fox Clients in Florida

They Need Your Help More than Ever!

Brevard Homeless Coalition

The lead agency for the Continuum of Care and management of homelessness in Brevard County. | brevardhomelesscoalition.org/get-involved

CREW Land & Water Trust

Dedicated to the preservation and stewardship of the water resources and natural communities in and around the Corkscrew Regional Ecosystem Watershed (CREW) in Southwest Florida. | crewtrust.org

Earn to Learn Florida

Empowers low- to moderate-income students to successfully complete college. | earntolearnfl.org

Friends of Foster Children Forever

Providing foster children in Southwest Florida with targeted educational and enrichment opportunities to allow each child to fulfill his/her potential. | friendsoffosterchildren.net

Henegar Center Performing Arts Center

The Henegar Center entertains, educates, and enriches by producing the highest quality performing arts experiences. | henegarcenter.com

Jacksonville Civic Council

Shaping Jacksonville’s future as a premier national and international city. | jaxciviccouncil.com

Marine Resources Council / Save the Indian River Lagoon

Improve water quality and to protect and restore the fish and wildlife resources of the Indian River Lagoon (Space Coast), coastal waters, inshore reefs, and the watershed by advocating and using sound science, education and the involvement of the public at large. | savetheirl.org/

My Autism Connection

A member-driven organization that offers services for autistic adults ages 18-50 across Southwest Florida. | myautismconnection.net

Reinvented Magazine

Supporting young women in STEM on the Space Coast and beyond. | www.reinventedmagazine.com

South Brevard Sharing Center

A community agency on a mission to support, strengthen and empower families to achieve self-sufficiency in south Brevard County. | www.mysbsc.org

STARability Foundation

Transforming the lives of individuals with disabilities through social, vocational and educational connections to the community, while strengthening awareness and respect for individual abilities. | starability.org

Introducing the Chart of Accounts (COA)

Are you ready to nerd out on nonprofit accounting?

A clean chart of accounts promotes organizational sustainability and high performance.

Accurate data empowers organizations to:

- Have meaningful financial conversations

- Eliminate uncertainty as to financial positions

- Guide decision making

- Provide clarity on organizational health

- Generate data for grant applications

- Build a financial case for fundraising initiatives

- Encourage financial transparency (donors respond well to transparency)

- And so much more…

When our team brings on a new client, we review their chart of accounts right away and provide recommendations for improvement as needed. It’s just that important.

So, let’s dive in and learn a bit more!

What is a Chart of Accounts?

- ASSETS [WHAT YOU OWN]: cash, inventory, fixed assets, accounts receivable, prepaid expenses, investments

- LIABILITIES [WHAT YOU OWE]: accounts payable, short or long-term debt, payroll taxes, deferred revenue

- EQUITY [WHAT YOU’RE WORTH]: retained earnings, unrestricted assets, temporarily or permanently restricted net assets

- INCOME [WHAT YOU RECEIVE]: contributions, pledges, grants, revenue, investment income

- EXPENSES [WHAT YOU SPEND]: office supplies, salaries, printing costs, bills, rent, purchase orders

Keep in mind that the list above is not exclusive. If you’d like to see the all-encompassing chart of accounts, refer to the Unified Chart of Accounts (UCOA). This was designed for nonprofits with every possible account included, and it mirrors categories on the IRS Form 990.

Do we recommend copying the UCOA? Nope! It makes more sense to design your chart of accounts to reflect your organization's exact needs. Keep it as clean and simple as possible.

How to Set up your Nonprofit Chart of Accounts

As we mentioned above, there are five recommended categories for a nonprofit's chart of accounts: assets, liabilities, equity, income, and expense. Each category should be assigned a specific number sequence to conform to best practice.

Here’s a standard chart of accounts numbering designation for nonprofits:

Assets – 1000

Liabilities – 2000

Equity – 3000

Income – 4000

Expense – 5000+

These numbers will serve as the headers for your chart of accounts. Individual accounts will be broken down and classified within each category using corresponding number sequencing. For example, the accounts within the income category might have subcategories like this:

Individual/Small Business Contributions – 4010

Corporate Contributions – 4020

Legacy and Bequests – 4070

Uncollected Pledges – Estimated - 4075

Foundation/Trust Grants - 4230

Federal Grants - 4520

This is a basic example. The standard chart of accounts we start with at Blue Fox contains just over 100 line items and includes sub headers to group similar accounts.

We encourage nonprofits to keep their COA simple (we call it “natural”) while still segmenting data enough that it delivers meaningful information for future decision-making.

Here is some other Blue Fox chart of account best practices for nonprofits:

- As shown above, always number your accounts (not everyone does this)

- Why? Because software like QuickBooks tends to organize reports based on alphabetical account names if there are no account numbers in use. This can be a more confusing, or at least, less meaningful way to organize the data.

- Header accounts should never have a balance in reports

- Special events should have their own section for both revenue and expenses for nonprofits

- Account titles should be as unique as possible

- Generally, accounts should line up to the income and expenses as listed on the 990

- Keep in mind that the COA ultimately must work for management

- Note of caution: if you're leaning too much toward what people want to see, your COA may not be natural, and you run the risk of not fully leveraging other tools in QuickBooks for additional dimensionality

- Example: if the board wants to see subaccounts under Salaries & Wages on the P&L that show everyone’s individual pay, that is not the correct approach. Over time and with staff turnover, you could easily have dozens and dozens of subaccounts which make reports excessively long and complicated

- If you choose to revise your COA, be sure to create a roadmap of sorts for your tax/audit team so that they understand the changes you’ve made and why

If you have any questions about revamping your nonprofit’s chart of accounts, our friendly team is happy to help!

Give us a shout, and we'll get you sorted.

Plus: Our recommendation on EIDL repayment

The Basics:

- COVID-related EIDL funds are exhausted. The Small Business Association is not accepting additional requests for increases or reconsiderations.

- To view your EIDL details, you must sign up for an account here: caweb.sba.gov.

- Keep your address up-to-date for mailed payment notifications.

- EIDL payments can be made here: https://www.pay.gov.

- If your business closes, notify the SBA at (833) 853-5638.

Our Recommendation for EIDL Repayment:

HERE'S WHY:

- Although loan payments are deferred for 30 months as of March 2022, interest is still accruing daily. The documents you find on your account at caweb.sba.gov will show you the daily interest accruing.

- If you don't make a payment during the 30-month deferral period, and you only make regular monthly payments for the full 30 years of the loan, you will have a sizeable balloon payment at the end of the loan!

Here's our CEO's Actual Email Response

Jina and Randi looped me in on your recent discussion regarding covering medical travel and abortion travel. I understand you all will speak with your health insurance advisors on this, which is a good next step.

I suggest that you speak to your general counsel/corporate attorney as well because, depending on how this unfolds, there could be an additional risk to employers who want to offer this kind of support if the structure of the reimbursement doesn’t line up with the current guidance in the code regarding medical reimbursements.

Here’s a brief overview of some considerations. What we’re probably looking at to keep employer risk as low as possible is the setup of a Health Reimbursement Account (HRA) with clearly outlined policies on what types of expenses will be covered. This would answer potential questions from employees like:

- If her abortion travel is covered, can my facelift be covered? (That’s a crazy example but just saying the crazy stuff is what we have to solve for as employers sometimes… )

- Does the abortion have to be medically necessary to cover the travel? (The answer will determine if an employee could ask for travel coverage for any elective procedure.)

I just wanted to add this additional insight in case it’s helpful.

The lawyers on both sides will have a field day with this…

Suppose Congress supports the Court’s decision to overturn Roe v. Wade and puts pressure on the Treasury. In that case, we may even be looking at a future where employers who choose to cover abortion travel will be subject to an audit of their fringe and health benefits more regularly. (Think: the travel benefit is set up as non-taxable, and because proper plan documents or policies aren’t in place, the IRS claws it all back and makes it taxable to the employer and employee. Then adds penalties, fines, and interest.)

For all these reasons, I strongly suggest legal guidance before proceeding.

Let me know if you want to talk this through more.

Chantal

NOTE: Blue Fox is an advisory and financial consulting firm, not a law firm or a public accounting firm. Any anecdotal advice shared here should not be relied upon for decision-making. Please consult a CPA, attorney, or other qualified professional before making changes to any benefits policy.

Our Blog

Welcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy!

Top Articles

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits

Behind the Scenes, New Client Onboarding Call

When to Hire a Tax Professional - 10 Factors to Consider

40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members

Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients

Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know

The Magical Nonprofit Financial Ratio Matrix

10 Reasons to Outsource Your Nonprofit Accounting

How to Make Your Nonprofit Recession-Proof

How to Engage Your Board of Directors in Financial Conversations

QB Tip of the Month: How to Use Classes for Painless Grant Writing

When to Hire an Accountant for Your Social Impact Org

Are You Paying Too Much for Payroll?

Company News

Blue Fox Earns Better Business Bureau Accreditation

Blue Fox Launches Protected By Logo

Blue Fox - The Origin Story

Categories

All

Blue Fox Foundation

Company News

For Individuals

For Nonprofits

For Social Enterprises

Press Announcements

Archives

July 2024

June 2023

March 2023

January 2023

October 2022

September 2022

August 2022

July 2022

June 2022

May 2022

April 2022

March 2022

December 2021

November 2021

October 2021

September 2021

August 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

September 2019

August 2019

July 2019

June 2019

May 2019

April 2019

March 2019

February 2019

January 2019

November 2018

October 2018

September 2018

RSS Feed

RSS Feed