Raise your hand if you love being audited. Anyone? Anyone? We didn’t think so. At most companies, audit time causes anxiety and panic. And, the pressure doesn’t stop there. As a financial services and advisory firm, we’re under the microscope too. For many nonprofit organizations an audit is an annual occurrence (often mandated in the bylaws or by state law). From a fundraising perspective, a clean audit can demonstrate sound financial stewardship and pave the way for increased donor trust and giving. That’s why our team at Blue Fox views a client audit as a management and marketing opportunity, as well as an important financial management exercise. Using the right tools and technology, we’ve reduced the tedious audit process from an average 10 hours down to just 2. That’s an entire workday saved – you’re welcome! How did we do it? One app: Bill.com. We’re such big fans of Bill.com’s audit effectiveness that Bill.com asked our CEO, Chantal Sheehan to write about it on their blog. In the full article, How to Help Your Clients Get a Clean Audit, she highlights 3 key features at Bill.com that help our clients get clean, fairly painless audits each year: (1) Digitized, paperless records (2) Enforcement of internal controls (3) Audit trail feature The full article gives specific details and examples. It’s a must read! Is your organization looking for nonprofit audit preparation services? Give us a call at (321) 233-3311 or request a meeting. We’ll get you sorted! Then you can focus on what really matters: your mission and serving your community. Related Articles 5 Tips to Get You A Clean Audit Every Year Nonprofits - It's Time to Automate Your Back Office 10 Reasons to Outsource Your Nonprofit Accounting

0 Comments

If you’re like us, your daily inbox is jam-packed with newsletters and educational opportunities from like-minded social impact leaders. These spectacular humans work around the clock to foster positive change in their communities. Then, somehow, find time to share their story. We tip our hat to them! Here are just a handful of our favorite resources this month:

Thanks for stopping by to explore our picks for social enterprise news this month! If you’re interested in hearing more from us, subscribe to our newsletter today! A Story About How We Serve Clients… When Bill.com calls to interview your CEO, you jump at the opportunity! Especially when they mention that your CEO is viewed as an industry-leading financial services provider and they want to share her expertise. And, now we’re blushing! READ THE FULL INTERVIEW HERE: Blue Fox, AI, and Maximizing Value for Accounting Clients Our CEO, Chantal Sheehan has first-hand experience with the challenges that nonprofit face and has structured Blue Fox services to support those unique challenges. In this interview, she explains how Blue Fox takes advantage of Bill.com’s AI-powered Intelligent Virtual Assistant to most efficiently serve clients. One of our favorite quotes from the interview is when our CEO, Chantal Sheehan said, “We focus on leveraging technology like AI so that we can apply human time where it counts for clients.” This is part of the Blue Fox philosophy and why we work so hard to provide the latest and greatest technology solutions for our clients. If your nonprofit or social enterprise is looking to professionalize your back office operations, give us a shout any time at (321) 233-3311 or [email protected]. Nonprofits, take note. This is important! |

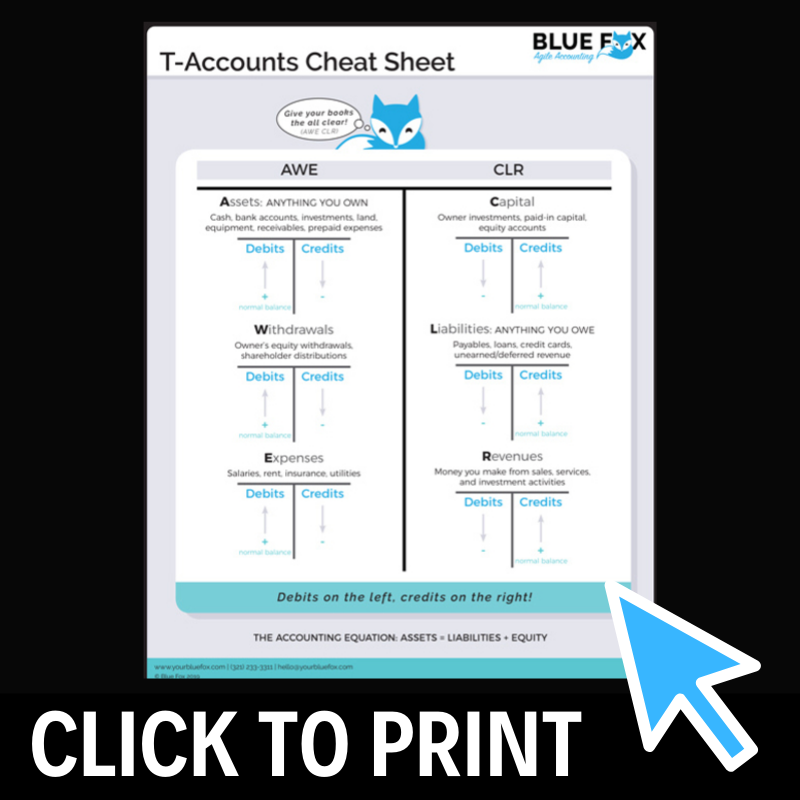

| T-Accounts are a visual representation of the fundamental concepts of double-entry accounting. If you're a bookkeeper or controller, you're no stranger to the double-entry system. But if you don't have formal accounting training, it can be tough to remember what goes where when you're making a journal entry adjustment to the books. Grab this quick cheat sheet for an easy 1-page guide to T-Accounts. Complete with a pneumonic helper, the more you refer to this in the short term, the more it will get locked into your brain! You won't be that bookkeeper referring to a cheat sheet multiple times a day after a few weeks of using this handy guide. |

There's an old accounting story that professors still tell to this day:

She locks the drawer every night before she leaves, and the other office staff gossip quietly every day about what's in the drawer. Chocolate? Can't be. It's not edible. A pet rock? Possibly. She's a little quirky. They speculate endlessly.

One day, the bookkeeper dies suddenly. The business owner gets her desk drawer keys from her family a few days later. The office gathers around as the big secret of the drawer is revealed. What's in it?

A simple piece of paper with the words "Accounting Bible" at the top. On the sheet is a strange coded set of words and symbols labeled "T-Accounts." The office staff stares in wonder, unable to make anything out of it. Then someone puts it back in the drawer and they walk away... Guess she really was an odd duck.

Get your very own Accounting Bible here ;)

Our Top Picks - Social Enterprise News

- Social Entrepreneurs, Create A Startup Then Do Good Like These Companies

- Points of Light Announces the Civic 50 for 2019

- Moving Toward an Inclusive and Regenerative Economy

- 5 Ted Talks for Social Enterprise Leaders

- More Investors Exploring Nature-based Growth Opportunities

Thanks for stopping by to explore our picks for social enterprise news this month! If you’re interested in hearing more from us, subscribe to our newsletter today!

About Blue Fox: Our team provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to comprehensive virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.yourbluefox.com.

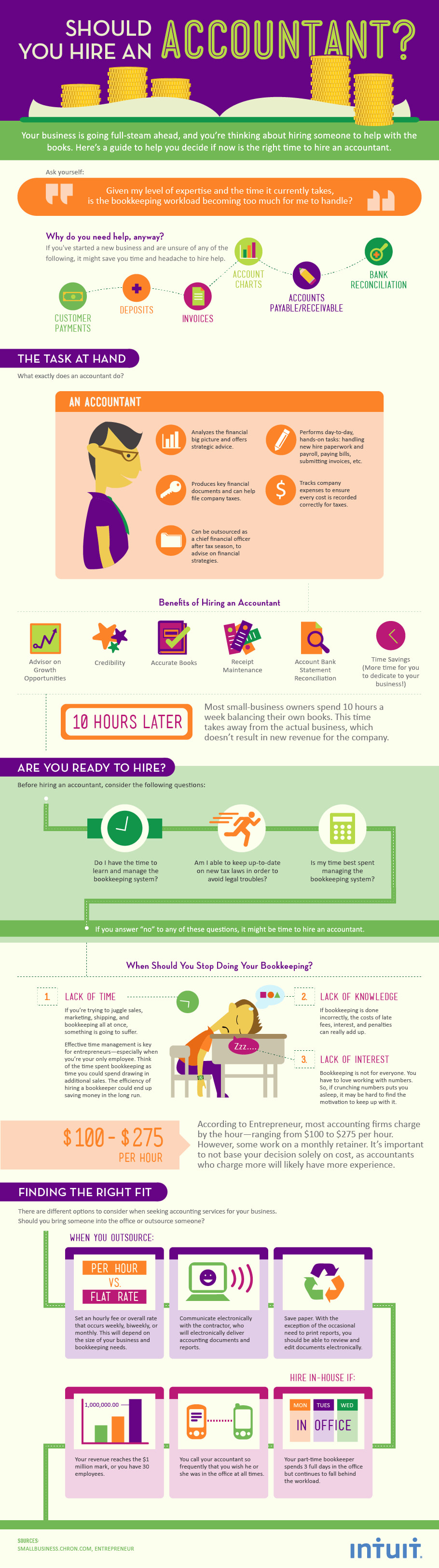

Did you know that most small businesses owners spend 10 hours per week balancing their books? That equates to about 25% of a 40-hour work week spent on non-revenue generating or mission-related tasks. We know social impact executives often work longer hours than most but still - 10 hours is probably 9 hours too many don’t you think?

But are you ready to outsource your nonprofit accounting function?

How do you know when the time is right?

Ask yourself these questions:

- Do I have the time to learn and/or manage the bookkeeping system?

- Am I able to stay up-to-date on new tax laws in order to avoid legal troubles?

- Is my time best spent managing the accounting system?

- How much does my bookkeeper’s time (or my time) cost compared to accounting firm fees?

- Does staff turnover affect our back-office efficiency?

- Is the board of directors asking me to provide financial data beyond my ability? And a corollary: do I spend at least half a day before each meeting prepping financial reports?

- Wouldn’t it be nice to wow the board with some snazzy reports like financial dashboards?

Most nonprofit leaders were not born to be CFOs. Many social impact executives come from a marketing or fundraising background. The choice to hire an accounting firm can give marketing-minded executives piece of mind. It’s like bringing on the perfect business partner with complementary expertise. A ‘balanced’ partnership (accounting pun intended). ;)

So, what exactly can an outsourced accounting firm do for your organization?

- Analyze the financial big picture and offer strategic advice.

- Produce key financial documents and can help with annual tax filings

- Can act as a chief financial officer beyond tax season, to advise on financial strategies

- Perform day-to-day hands-on tasks like handling new hire paperwork and payroll, paying bills, submitting invoices, etc.

- Track company expenses accurately and maintain a healthy audit trail

- Ensure compliance with local, state and federal tax law

- Set-up and integrate the best, latest and greatest financial technology solutions to maximize efficiency and save time

- Assist with and ensure a smooth audit process

Our team at Blue Fox offers all of those services and more! Blue Fox is an accounting firm specifically for nonprofits and social enterprises. Our team members have broad expertise in the social impact space, with backgrounds as nonprofit leaders, board members and volunteers. The entrepreneurial spirit runs deep on our team. This means we manage your back-office from the same perspective as you would. Not sure about it; just ask our clients and read what they have to say about us.

If you think it may be time to hire an accounting firm, let’s have a chat and see how Blue Fox can help you reach your goals. Call us anytime at (321) 233-3311 or click here to request more information and/or a quote.

It’s now trickier than ever to capture the attention of your stakeholders. And without their attention how do to you establish buy-in and encourage action?

There has to be a better way!

Enter financial dashboard style reporting. Charts. Graphs. Visuals. Infographics. With a little illustrative razzle dazzle, your board members are paying attention. Better yet, they can quickly see your overall financial position. Gone are the days of reviewing tedious financial statements and boards of directors are thrilled!

Ruth McCambridge, Editor in Chief of the Nonprofit Quarterly explains it best, “A well designed dashboard shows whether a nonprofit is making headway on its critical variables… it organizes and focuses conversations.”

So, what do you include on your dashboard? Well, ask yourself what drives the success of your organization? Do you have defined strategic objectives that are measurable? You might measure quantity of memberships or donations, clients served to date, cash on hand, program income budget vs actual, annual revenue by source, restricted vs unrestricted funds, and so on. The possibilities are endless – the question is: what key information matters most to you and your management team?

Our team at Blue Fox builds dashboards for clients upon request. Some are more extensive and others are one-page snapshots. Customization is key and no two organizations have exactly the same needs. The common factor is that our clients present interesting, concise, actionable data to their stakeholders to make their board and management meetings truly useful moments.

About: Our team at Blue Fox provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to full-blown virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com.

Resources:

- Nonprofit Quarterly & FMA, How to Build a Dashboard for your Nonprofit: A Critical Strategic Tool Reveals Itself

- Time, You Now Have a Shorter Attention Span Than a Goldfish, Kevin McSpadden

Here's the Financial Technology Tools We Recommend and Use, The Blue Fox Tech-Stack for Nonprofits and Social Enterprises

Any Scrabble junkies want to pull out the dictionary and challenge us? Go ahead. Just know that new technology may take over before Merriman Webster can crank out a new print edition.

Constant change in the financial technology space can overwhelm small businesses, especially those in the nonprofit and social impact space. But rest assured that Blue Fox is hip to the newest developments in nonprofit financial management technology. We stay up to speed on innovations in the FinTech space so that we can provide you with the most useful and reliable technology tools out there.

Here's a sampling of our favorite back office technology solutions for nonprofits, social enterprises and small businesses:

- Bill.com – Automates and simplifies the way you pay bills, send invoices, and get paid. Electronic vendor payments and a perpetual audit trail are our favorite features of this revolutionary platform.

- Box - Secure collaboration with anyone, anywhere, on any device.

- Defendify - Streamlines multiple layers of cybersecurity through a single platform, ongoing guidance, and expert support.

- Divvy - The all-in-one expense management solution.

- Hive - The only project management platform for hybrid work, shaped by users.

- Intuit QuickBooks Online – With over 5.6 million global users, QuickBooks Online breeds efficiency, accuracy, collaboration, organization, automation and oversight over all aspects of your organizations financial picture. Bank-level encryption, payroll processing, and the ability to integrate CRMs and project management apps make QuickBooks Online the leader in small business accounting software.

- Gusto - One place for payroll, benefits, and so much more.

- Citrix ShareFile – 100% secure file storage with 24/7 file accessibility. Dropbox, Box, and Google Drive are good solutions, but Citrix security, encryption, and granular user privileges are unrivaled in the cloud storage space.

- JustWorks - Simple software + expert support for payroll, employee benefits, HR services, and compliance.

- LastPass - Password Management from Anywhere

- UltraTax CS - Professional tax software for tax preparers and accountants.

The core of our Blue Fox philosophy is the marriage of technology and humanity – that’s why our tagline is Agile Accounting for Impact. We believe that the right mix of automation and human-touch makes all the difference. Just ask our clients! If your organization feels the same, we want to work with you! Don’t hesitate to call us at (321) 233-3311 or book a free consultation with us today!

- Business: $0.58 per mile

- Medical or moving: $0.20 per mile

- Charitable: $0.14 per mile

Ever wonder: what goes into those rate changes? Is there just a dude sitting at Treasury somewhere who makes the call, or is there a formula of some kind in place? As satisfying as it might be to blame an unknown dude at Treasury, it turns out there are a few known factors that go into the mileage rate calculation:

- Fuel costs

- Vehicle maintenance costs

- Insurance rates

- Actual costs to purchase a vehicle

Generally, when the costs above go up, we see an increase in the mileage rate. And when they go down, we see a decrease. As a consumer, though, it often feels to me like the best indicator that there will be an increase is gas prices. (If you want to geek out and compare historic fuel prices with historic mileage rates, have at it. We did!)

In 2019, gas prices are expected to continue to rise so the IRS has provided a 3.5 cent bump to the business mileage rate. (Woohoo! Don’t spend it all in one place!) If you use an app like Expensify, MileIQ, or Motus to track your business miles, the apps should compute your mileage reimbursement correctly.

If you’re old school and using a paper expense report to get mileage reimbursement from your employer, or to track your own business mileage deduction, then you’ll want to correct all your expense report formulas and forms to reflect the new rate.

And stay tuned: word on the street is that there might be a 2nd mileage rate hike mid-year if gas prices aggressively rise this year.

About: Our team at Blue Fox provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to full-blown virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com.

Author: Founder & CEO, the Original Blue Fox, Chantal Sheehan, MS, CFP(r)

Our Blog

Welcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy!

Top Articles

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits

Behind the Scenes, New Client Onboarding Call

When to Hire a Tax Professional - 10 Factors to Consider

40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members

Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients

Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know

The Magical Nonprofit Financial Ratio Matrix

10 Reasons to Outsource Your Nonprofit Accounting

How to Make Your Nonprofit Recession-Proof

How to Engage Your Board of Directors in Financial Conversations

QB Tip of the Month: How to Use Classes for Painless Grant Writing

When to Hire an Accountant for Your Social Impact Org

Are You Paying Too Much for Payroll?

Company News

Blue Fox Earns Better Business Bureau Accreditation

Blue Fox Launches Protected By Logo

Blue Fox - The Origin Story

Categories

All

Blue Fox Foundation

Company News

For Individuals

For Nonprofits

For Social Enterprises

Press Announcements

Archives

July 2024

June 2023

March 2023

January 2023

October 2022

September 2022

August 2022

July 2022

June 2022

May 2022

April 2022

March 2022

December 2021

November 2021

October 2021

September 2021

August 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

September 2019

August 2019

July 2019

June 2019

May 2019

April 2019

March 2019

February 2019

January 2019

November 2018

October 2018

September 2018

RSS Feed

RSS Feed