Nonprofits, When to Apply for PPP Loan ForgivenessSo, you received PPP funds.

What do you do now? How do you make sure your loan is forgiven? If you're asking these questions, you're not alone! What we know:

As always, our team is happy to answer questions and help your organization navigate current financial challenges. Give us a call at (321) 233-3311 or email [email protected].

0 Comments

Raise your hand if you love being audited. Anyone? Anyone? We didn’t think so. At most companies, audit time causes anxiety and panic. And, the pressure doesn’t stop there. As a financial services and advisory firm, we’re under the microscope too. For many nonprofit organizations an audit is an annual occurrence (often mandated in the bylaws or by state law). From a fundraising perspective, a clean audit can demonstrate sound financial stewardship and pave the way for increased donor trust and giving. That’s why our team at Blue Fox views a client audit as a management and marketing opportunity, as well as an important financial management exercise. Using the right tools and technology, we’ve reduced the tedious audit process from an average 10 hours down to just 2. That’s an entire workday saved – you’re welcome! How did we do it? One app: Bill.com. We’re such big fans of Bill.com’s audit effectiveness that Bill.com asked our CEO, Chantal Sheehan to write about it on their blog. In the full article, How to Help Your Clients Get a Clean Audit, she highlights 3 key features at Bill.com that help our clients get clean, fairly painless audits each year: (1) Digitized, paperless records (2) Enforcement of internal controls (3) Audit trail feature The full article gives specific details and examples. It’s a must read! Is your organization looking for nonprofit audit preparation services? Give us a call at (321) 233-3311 or request a meeting. We’ll get you sorted! Then you can focus on what really matters: your mission and serving your community. Related Articles 5 Tips to Get You A Clean Audit Every Year Nonprofits - It's Time to Automate Your Back Office 10 Reasons to Outsource Your Nonprofit Accounting Fundraisers certainly have their work cut out for them this year. Coronavirus. Racism. Unemployment. Riots. Business closures. Natural disasters. A contentious election year. All of these make for a super challenging fundraising environment. So, what’s a fundraising organization to do?

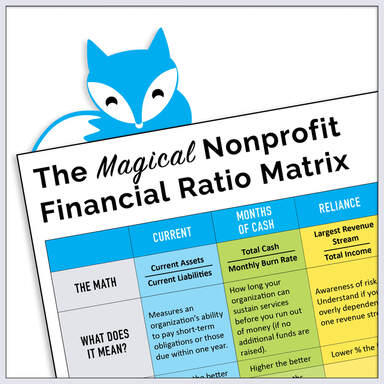

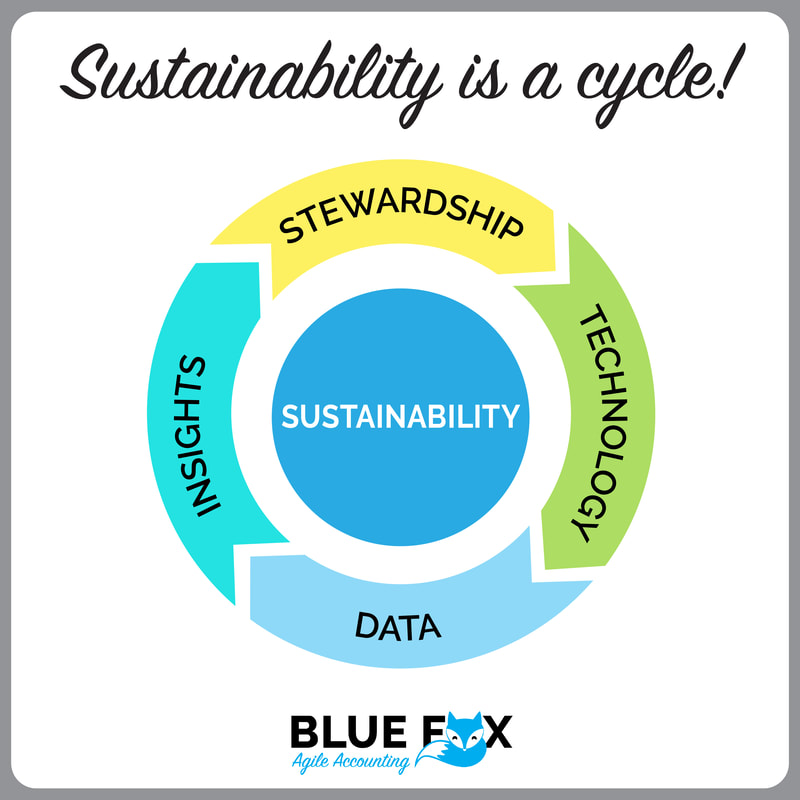

Chances are, you’re already making lemons out of lemonade. We applaud all of you nonprofiteers for a quick pivot to digital fundraising, virtual events, and redirecting your focus on personal donor communication strategies. Strong relationships are more important than ever. And, our team at Blue Fox would like to offer: “What if those relationships are paired with strategic financial knowledge? How much more effective could your fundraising team be?” Our CEO, Chantal Sheehan recently wrote a guest feature article for Bloomerang addressing this exact question: 4 Finance Secrets to Help You Raise More Money. (1) Know Your Burn Rate (2) Be Transparent and Fluent in Financial Data (3) Demonstrate Financial Resilience (4) Understand How to Frame Overhead as Programmatic Support The full article gives specific details and examples. It’s a must read! If your team could use guidance implementing these suggestions, our friendly team at Blue Fox is here to help! Give us a call at (321) 233-3311 or email. We’ll get you sorted! Then you can focus on what really matters: your mission and serving your community. Related Articles 6 Step Guide to Build Donor Trust Our Favorite Resources for Nonprofit Fundraisers Kindness Leads to More Profit and Productivity [PREFACE: This blog article was started pre-coronavirus pandemic. That’s why the first sentence doesn’t start, “During these difficult times,” and the context doesn’t talk about COVID-19 throughout. However, it’s important to note that building a financially sustainable nonprofit is your best shot to keep services running during tough economic times such as these. So, let’s get to work.] In the nonprofit world, nirvana is achieved through financial sustainability. We’re talking about a level of sustainability that most organizations only dream about: fully funded operating reserves, available lines of credit, multiple revenue streams, and a full understanding of when the money flows in, how to leverage it, make it grow, and how it is best spent. Financial sustainability creates its own beautiful cycle. It breeds proactive leadership, strategic direction, and organization growth. Why? Because social impact leaders with a comprehensive understanding of their financial operations can confidently communicate, empower and build trust with their stakeholders. And, trust leads to increased financial support. [6 Step Guide to Build Donor Trust] This high-performing type of organization is 100% possible! We know because we’ve seen countless organizations transform, including many of our clients. So, where does a nonprofit start? Here’s a model of the 4-part system that our CEO, Chantal Sheehan uses to help nonprofits achieve financial sustainability. It’s a cycle. It’s a system. The flow creates continuous improvement and continuous analysis. Let’s break it down… StewardshipSimply put, stewardship is nurturing, supporting, and taking care of something. Its time spent thinking, planning, talking, and taking action to ensure long-term viability. Ask yourself. Does your team steward your financial operations as much as other organizational activities? Think about how much time your team spends each week on fundraising? How much time do you spend cultivating donors? How much of your time is spent chasing donations and grant money? 50% of your week? 70%? Maybe even 90%? Now, how much time do you spend analyzing how those hard-fought dollars are used? Do you have regular meetings with your team about finance? Do department or program heads talk about budget in real-time and regularly? In most cases, the time spent on financial management (stewardship) is not even close to the time spent raising the funds. It’s time to change that dynamic and take one huge leap closer to financial sustainability. “Sustainability starts with a commitment to apply the same principles and stewardship to finance as we apply to fundraising and donor relationships.” – Chantal Sheehan, Blue Fox CEO Technology The use of modern financial technology is a critical support mechanism for financial stewardship. Tech platforms have come a long way in the last decade. They are more cost-effective and affordable than ever, and it’s time for nonprofits to get on board. Using financial technology appropriately is no longer just a plus for nonprofits… it’s a must. FinTech or bust! [Our Favorite Back Office Technology Solutions] Some reasons why social impact organizations should adopt or seek out best of breed financial technology:

* Side note on “cloud-based”: Let’s get coffee if you think we’re talking about actual clouds here :) DataData. It’s not just a word for nerdy back-office folks crunching numbers. Data is a word used by proactive smart leaders. Data is what gives nonprofit executive directors, CEOs and board members the ability to make reasoned, educated decisions. Data is the pencil that draws the blueprints for strategic planning. If your last organizational decision was made by intuition, why not generate some data to check yourself and provide evidence? Data breeds buy-in too. When it comes to collecting data, our CEO always says, “Garbage in, garbage out.” If your FinTech is working for you the way it should be, avoiding bad data should be straightforward. But here are some operational decisions for your team to consider to ensure your data is squeaky clean:

Insights Now that your data gleams, it’s time to use it to generate insights. Data tells you what happened. Insights tell you why something happen, why something failed to happen or what might happen next. Insights result from analysis and discussion. One of the best ways to analyze and discuss data is to make it visual whenever possible. Here are some tools that make financial data visual and encourage your team to generate insights to aid in organizational decision making:

Once you’ve taken your data from snooze-fest to wow-fest, you’ll notice a fairly immediate shift in how your team discusses it. Insights will begin to reveal themselves, giving you the capacity to make informed decisions and strategic moves as needed. Stewardship (Yes, Again)  It’s time to close this loop of continuous improvement and analysis. Let’s talk about, plan for and become proactive (a.k.a. steward) about your financial situation to put your organization in a more sustainable position. Data and the insights they reveal show you what financial risks and opportunities exist. Now, relate those to your external and internal environments. Determine what changes you can make now so that your organization is stronger and better able to mitigate risks. Think about how these new insights should inform changes to your current fundraising initiatives, revenue goals, operational plans, and program strategies. Then plan for a rainy day. Shore up any potential cash flow weak spots by acquiring a line of credit and creating an operating reserve (5 Key Elements Your Operating Reserves Policy Needs). Do this year after year, and you will watch your organization shift from reactive to proactive, and sustainability will follow. As always, if your team could use support implementing this system at your nonprofit, Blue Fox is her to help! Give us a call at (321) 233-3311 or email hello@yourbluefox. Feel free to learn more about our philosophy, clients, services and our team before you make that call. Now, let’s get to work! By: Blue Fox CEO, Chantal Sheehan and Marketing Guru, Chelsea Clementi |

Our BlogWelcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy! Top ArticlesBack to Basics: How to Set Up Your Nonprofit Chart of Accounts

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits Behind the Scenes, New Client Onboarding Call When to Hire a Tax Professional - 10 Factors to Consider 40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know The Magical Nonprofit Financial Ratio Matrix 10 Reasons to Outsource Your Nonprofit Accounting How to Make Your Nonprofit Recession-Proof How to Engage Your Board of Directors in Financial Conversations QB Tip of the Month: How to Use Classes for Painless Grant Writing When to Hire an Accountant for Your Social Impact Org Are You Paying Too Much for Payroll? Company NewsBlue Fox Teams Up With Bloomerang to Develop Nonprofit Resources

Blue Fox Earns Better Business Bureau Accreditation Blue Fox Launches Protected By Logo Blue Fox - The Origin Story Categories

All

Archives

July 2024

|

BLUE FOX

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

RSS Feed

RSS Feed