The 4 Most Common Payroll and Tax Compliance Mistakes and How to Avoid Them There’s something stinky in the air lately. It smells like past payroll mistakes. And it takes a while to clean up. Here’s the reality: you want a badass bookkeeper, not a BAD bookkeeper! Nonprofit bookkeepers must understand nonprofit payroll and tax compliance. If they don’t, preparers beware. Our accounting team has been cleaning up many stinky payroll messes lately. The kind of messes that only come to light during W-2/1099 time. And many of which started with a tiny mistake years ago that snowballed into a significant issue. So, we thought we would share a few examples to help other nonprofits keep their books and payroll tax situation clean and avoid the cost and totally unnecessary stress of rework. (1) Incorrectly recording a virtual employee’s work location in the payroll system.HE MISTAKE: This is a common mistake with the rise of a virtual workforce. If an employee’s work location (the state they physically work in) is not recorded correctly within the payroll system, the payroll provider will not withhold state income taxes properly. Payroll taxes must be paid and withheld based on the state that an employee works in, NOT the state where their employer is located. This mistake is typically caught when employees receive their W-2s. THE FIX: The employer will need to create a new W-2 and amend all previous quarterly state (and local, where applicable) tax returns to correct the issue. This is a HUGE headache and may result in many penalties and fees. HOW TO PREVENT IT: In the payroll system, ensure all remote employees have a work location that reflects their physical location. (2) Data is not fully transferred when switching payroll providers. THE MISTAKE: Companies that switch from one payroll processor to another in the middle of the year, beware. Often, some historic or employee data isn't properly transferred to the new provider. This causes (1) incorrect filing of payroll forms (federal and state) for the period this occurred, (2) errors related to benefits and deductions like retirement balances, unemployment compensation, and workers comp. This mistake is not typically noticed until year-end when W-2 forms are prepared or when the IRS/state sends the notice. IRS penalties can occur. THE FIX: Audit the data transfer between payroll providers to determine what went wrong. Then ensure the new provider has completed and corrected information before issuing W-2s. HOW TO PREVENT IT: Follow this Switching Payroll Providers Checklist and carefully compare prior employee records/paychecks to current ones after a payroll transition to ensure data accuracy. (3) No one files quarterly tax forms (yes, it happens).THE MISTAKE: Payroll tax returns never get filed in the hustle and bustle of running a nonprofit organization. Typically, the IRS will send notice, and penalties apply. If there was turnover in the payroll administrator position, it would likely take some digging to figure out what was filed and what was not. THE FIX: Pay penalties and backfile tax returns. This is a nightmare from an administrative standpoint. HOW TO PREVENT IT: Hire a professional accounting firm (like us) to manage payroll, follow payroll tax and compliance deadlines, and properly prepare your payroll tax returns. (4) Payroll taxes are paid in the wrong amount. THE MISTAKE: Someone with a lack of training in payroll taxes is responsible for the task. There is no reconciliation process, so payroll taxes are paid in the wrong amount. It can take up to a year to notice this mistake when the IRS sends notice and penalties. THE FIX: Pay penalties, recalculate payroll taxes, and pay the correct amount. HOW TO PREVENT IT: Hire a professional accounting firm (like us) to manage payroll, follow payroll tax and compliance deadlines, and properly prepare your payroll tax returns. Are you surprised by some of these examples?

Some of the preventative tips seem obvious, right?! File your taxes on time, pay the correct payroll tax, etc. It's easy to imagine how seemingly "small" things like this can get missed. Nonprofit leaders are stretched thinner and thinner these days with, you know, ALL THE THINGS like:

Nonprofit leaders need to know that they are not alone in feeling overwhelmed by financial management. Deep financial knowledge and expertise are not typically found in-house in the nonprofit sector, especially in organizations with budgets between $1-5 million. This is why Blue Fox exists. To lighten the nonprofit manager's load. To educate and serve nonprofits and social enterprises on all things financial management. We tell our clients that we’ll handle the stuff that keeps them up at night. If your organization struggles with payroll and tax compliance issues, give our friendly team a shout. We’ll get you sorted!

0 Comments

If you’re unfamiliar with the concept, Virtual CFO's may be called outsourced, part-time, or fractional CFOs. Nonprofit trend alert: Enter the virtual CFO (that's us, meet our team)! Chief Financial Officer. Head Honcho of All the Numbers. If you’ve ever met one, your mental picture of a traditional CFO is likely one of a middle-aged white guy wearing glasses, khakis, and a button down shirt hunched over a computer with paperwork all over his desk. Let’s call him Bob. We’re happy to report that, while Bob lives on in many businesses, a growing trend in finance that's disrupting the C-suite for good. Enter the outsourced, virtual CFO, or vCFO. Virtual or in-office, here's what to look for in a nonprofit CFO. If you’re unfamiliar with the concept, vCFOs may be called outsourced, part-time, or fractional CFOs. Google those terms and be amazed at the number of results. We think that 2022 will be another banner year for outsourced CFOs everywhere, so we thought it might be time to break it down for you. [Bonus read: 10 Reasons to Outsource Your Nonprofit Accounting] Here’s what you need to know: (1) WHO Virtual CFO's may either be a firm or an individual. Usually they are CPAs, senior accountants or bookkeepers, or other experienced and educated individuals who’ve held CFO or senior finance or accounting roles in the past. Likely female (more than half of all accountants in the US are women), these folks are highly skilled numbers nerds who can fill the CFO role just as well as (better than?) Bob. (2) WHAT What does an outsourced CFO do? They may be charged with a variety of tasks including bookkeeping, accounting, month-end closes, payroll, and financial reporting. But the real leverage in a Virtual CFO is the strategic guidance and financial planning she provides. Interpreting financial data in a way that makes sense to other members of the C-suite is job #1. The rest of the job is to take a proactive approach to finance with sustainability in mind. A vCFO helps organizations streamline its financial systems and processes, develop strategic budgets, manage financial risk, raise capital, and figure out exactly what is needed to get from where your business or nonprofit is today to where you would like it to go. (3) WHY A growing number of nonprofits (like our Fox-tastic clients) turn to vCFOs for these reasons:

(4) WHEN When to hire a vCFO is something we covered in this blog, but a different type of when question we get about Blue Fox is: when can we call you? The answer is: anytime. One big bonus of a vCFO is that, in most cases, they are available to support you, ask questions, present at meetings, and generally do whatever you need them to do anytime. 100% uptime, to poach a tech industry phrase. That’s because vCFO firms like ours pair a bookkeeper and a senior accountant on each client’s work. You can always reach someone on your virtual finance team and you’re never left in the lurch. Again, our singular agenda is: support you and your organization to the best of our ability at all times. (5) WHERE & HOW This is an easy one – outsourced CFOs can be remote and tend to deliver their services through cloud-based technology. It’s actually the recent evolutions in cloud-based accounting tech that make what we do possible – 10 years ago, the tech just wasn’t there. But now we can work with any client anywhere at any time. As a vCFO client, that also means you can pick from the nation’s top service providers, rather than just your local market. You can source vCFOs who specialize in your industry, and they can work for you from anywhere. Video and conference calls bridge the communications gaps, and our cloud-based tools allow us to securely exchange data and provide live, real-time accounting information all day long. Hopefully, now you can see why one the hottest business trends will continue to be the rise of the virtual CFO. Will your nonprofit be an early adopter? Our Team at Blue Fox Can Assist You Today!Whether your nonprofit is seeking a full-service Virtual CFO or basic accounting services (we also offer payroll, tax and consulting), our team of nonprofit gurus at Blue Fox are ready to assist you! We serve our clients with exactly the right mix of services to support their back office operations. And guess what?! We were recognized among the Top 5 Accounting Firms In Florida in 2021 by DesignRush. What does your organization need help with? Editors Note: This post was originally published in December 2019 and has been completely revamped and updated for accuracy and comprehensiveness. Here are some other articles you might enjoy reading:

10 Reasons to Outsource Your Nonprofit Accounting Why Should My Nonprofit Outsource Its Accounting? When to Hire an Accountant For Your Social Impact Organization The core of Blue Fox’s philosophy is the synergy between technology and humanity – that’s why our tagline is Agile Accounting for Impact. We serve our clients with the best solutions and virtual tools to run their nonprofit organization’s back office with efficiency and excellence. We listen to the nonprofit buzz every day and understand that tax compliance is a major pain point for many organizations. Queue a new #foxtastic partnership with Avalara. The team at Avalara lives and breathes tax compliance so your nonprofit can sit back and relax without having to be a tax expert in every state [especially with donors living all over]. Even better, their platform automates the major steps of tax compliance — all in the cloud. There are so many misconceptions about tax compliance in the nonprofit space. Here are three major areas of confusion:

So, why did our team at Blue Fox partner with Avalara? That’s simple: their services take care of nonprofits by limiting tax risk and building efficiency through automation and integration with Quickbooks. If you’re interested in learning more, let us introduce you to the tax experts at Avalara. Send us an email at [email protected] email. Want to learn more about who benefits from sales tax automation and how it can save time and money? Check out the free guide below with answers to your most important sales tax automation questions.

Nonprofits, When to Apply for PPP Loan ForgivenessSo, you received PPP funds.

What do you do now? How do you make sure your loan is forgiven? If you're asking these questions, you're not alone! What we know:

As always, our team is happy to answer questions and help your organization navigate current financial challenges. Give us a call at (321) 233-3311 or email [email protected].  Raise your hand if you love being audited. Anyone? Anyone? We didn’t think so. At most companies, audit time causes anxiety and panic. And, the pressure doesn’t stop there. As a financial services and advisory firm, we’re under the microscope too. For many nonprofit organizations an audit is an annual occurrence (often mandated in the bylaws or by state law). From a fundraising perspective, a clean audit can demonstrate sound financial stewardship and pave the way for increased donor trust and giving. That’s why our team at Blue Fox views a client audit as a management and marketing opportunity, as well as an important financial management exercise. Using the right tools and technology, we’ve reduced the tedious audit process from an average 10 hours down to just 2. That’s an entire workday saved – you’re welcome! How did we do it? One app: Bill.com. We’re such big fans of Bill.com’s audit effectiveness that Bill.com asked our CEO, Chantal Sheehan to write about it on their blog. In the full article, How to Help Your Clients Get a Clean Audit, she highlights 3 key features at Bill.com that help our clients get clean, fairly painless audits each year: (1) Digitized, paperless records (2) Enforcement of internal controls (3) Audit trail feature The full article gives specific details and examples. It’s a must read! Is your organization looking for nonprofit audit preparation services? Give us a call at (321) 233-3311 or request a meeting. We’ll get you sorted! Then you can focus on what really matters: your mission and serving your community. Related Articles 5 Tips to Get You A Clean Audit Every Year Nonprofits - It's Time to Automate Your Back Office 10 Reasons to Outsource Your Nonprofit Accounting Fundraisers certainly have their work cut out for them this year. Coronavirus. Racism. Unemployment. Riots. Business closures. Natural disasters. A contentious election year. All of these make for a super challenging fundraising environment. So, what’s a fundraising organization to do?

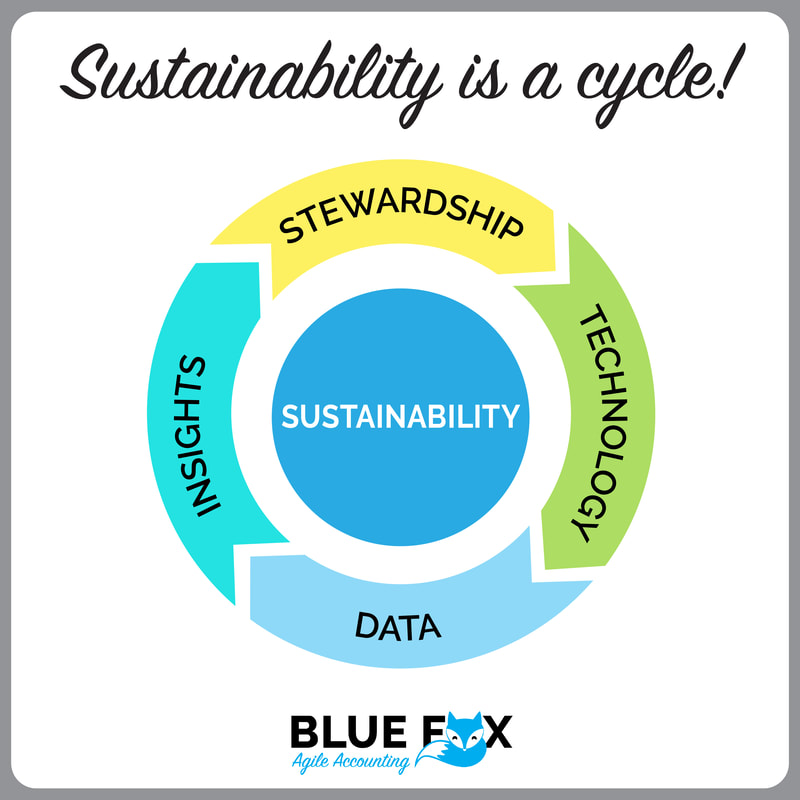

Chances are, you’re already making lemons out of lemonade. We applaud all of you nonprofiteers for a quick pivot to digital fundraising, virtual events, and redirecting your focus on personal donor communication strategies. Strong relationships are more important than ever. And, our team at Blue Fox would like to offer: “What if those relationships are paired with strategic financial knowledge? How much more effective could your fundraising team be?” Our CEO, Chantal Sheehan recently wrote a guest feature article for Bloomerang addressing this exact question: 4 Finance Secrets to Help You Raise More Money. (1) Know Your Burn Rate (2) Be Transparent and Fluent in Financial Data (3) Demonstrate Financial Resilience (4) Understand How to Frame Overhead as Programmatic Support The full article gives specific details and examples. It’s a must read! If your team could use guidance implementing these suggestions, our friendly team at Blue Fox is here to help! Give us a call at (321) 233-3311 or email. We’ll get you sorted! Then you can focus on what really matters: your mission and serving your community. Related Articles 6 Step Guide to Build Donor Trust Our Favorite Resources for Nonprofit Fundraisers Kindness Leads to More Profit and Productivity [PREFACE: This blog article was started pre-coronavirus pandemic. That’s why the first sentence doesn’t start, “During these difficult times,” and the context doesn’t talk about COVID-19 throughout. However, it’s important to note that building a financially sustainable nonprofit is your best shot to keep services running during tough economic times such as these. So, let’s get to work.] In the nonprofit world, nirvana is achieved through financial sustainability. We’re talking about a level of sustainability that most organizations only dream about: fully funded operating reserves, available lines of credit, multiple revenue streams, and a full understanding of when the money flows in, how to leverage it, make it grow, and how it is best spent. Financial sustainability creates its own beautiful cycle. It breeds proactive leadership, strategic direction, and organization growth. Why? Because social impact leaders with a comprehensive understanding of their financial operations can confidently communicate, empower and build trust with their stakeholders. And, trust leads to increased financial support. [6 Step Guide to Build Donor Trust] This high-performing type of organization is 100% possible! We know because we’ve seen countless organizations transform, including many of our clients. So, where does a nonprofit start? Here’s a model of the 4-part system that our CEO, Chantal Sheehan uses to help nonprofits achieve financial sustainability. It’s a cycle. It’s a system. The flow creates continuous improvement and continuous analysis. Let’s break it down… StewardshipSimply put, stewardship is nurturing, supporting, and taking care of something. Its time spent thinking, planning, talking, and taking action to ensure long-term viability. Ask yourself. Does your team steward your financial operations as much as other organizational activities? Think about how much time your team spends each week on fundraising? How much time do you spend cultivating donors? How much of your time is spent chasing donations and grant money? 50% of your week? 70%? Maybe even 90%? Now, how much time do you spend analyzing how those hard-fought dollars are used? Do you have regular meetings with your team about finance? Do department or program heads talk about budget in real-time and regularly? In most cases, the time spent on financial management (stewardship) is not even close to the time spent raising the funds. It’s time to change that dynamic and take one huge leap closer to financial sustainability. “Sustainability starts with a commitment to apply the same principles and stewardship to finance as we apply to fundraising and donor relationships.” – Chantal Sheehan, Blue Fox CEO Technology The use of modern financial technology is a critical support mechanism for financial stewardship. Tech platforms have come a long way in the last decade. They are more cost-effective and affordable than ever, and it’s time for nonprofits to get on board. Using financial technology appropriately is no longer just a plus for nonprofits… it’s a must. FinTech or bust! [Our Favorite Back Office Technology Solutions] Some reasons why social impact organizations should adopt or seek out best of breed financial technology:

* Side note on “cloud-based”: Let’s get coffee if you think we’re talking about actual clouds here :) DataData. It’s not just a word for nerdy back-office folks crunching numbers. Data is a word used by proactive smart leaders. Data is what gives nonprofit executive directors, CEOs and board members the ability to make reasoned, educated decisions. Data is the pencil that draws the blueprints for strategic planning. If your last organizational decision was made by intuition, why not generate some data to check yourself and provide evidence? Data breeds buy-in too. When it comes to collecting data, our CEO always says, “Garbage in, garbage out.” If your FinTech is working for you the way it should be, avoiding bad data should be straightforward. But here are some operational decisions for your team to consider to ensure your data is squeaky clean:

Insights Now that your data gleams, it’s time to use it to generate insights. Data tells you what happened. Insights tell you why something happen, why something failed to happen or what might happen next. Insights result from analysis and discussion. One of the best ways to analyze and discuss data is to make it visual whenever possible. Here are some tools that make financial data visual and encourage your team to generate insights to aid in organizational decision making:

Once you’ve taken your data from snooze-fest to wow-fest, you’ll notice a fairly immediate shift in how your team discusses it. Insights will begin to reveal themselves, giving you the capacity to make informed decisions and strategic moves as needed. Stewardship (Yes, Again)  It’s time to close this loop of continuous improvement and analysis. Let’s talk about, plan for and become proactive (a.k.a. steward) about your financial situation to put your organization in a more sustainable position. Data and the insights they reveal show you what financial risks and opportunities exist. Now, relate those to your external and internal environments. Determine what changes you can make now so that your organization is stronger and better able to mitigate risks. Think about how these new insights should inform changes to your current fundraising initiatives, revenue goals, operational plans, and program strategies. Then plan for a rainy day. Shore up any potential cash flow weak spots by acquiring a line of credit and creating an operating reserve (5 Key Elements Your Operating Reserves Policy Needs). Do this year after year, and you will watch your organization shift from reactive to proactive, and sustainability will follow. As always, if your team could use support implementing this system at your nonprofit, Blue Fox is her to help! Give us a call at (321) 233-3311 or email hello@yourbluefox. Feel free to learn more about our philosophy, clients, services and our team before you make that call. Now, let’s get to work! By: Blue Fox CEO, Chantal Sheehan and Marketing Guru, Chelsea Clementi A Letter From Our CEO, Chantal SheehanI’m over it.

COVID-19. The deaths. The sickness. The fear. The grief. The politics. The injustice. The media. The government screw ups. The lockdowns. The conspiracy theories. The economy. The unemployment rate. The PPP. The food supply. The feeling of loneliness. The worry. About everything. All the time. The hoarding. The sickness. The deaths. Oh look, murder hornets. WTF. I’m so over this s#!t. I know you are, too. That’s why I’ve decided it’s time to break up with COVID-19. As leaders and business owners, we have a job to do. Yes, we must acknowledge and accept the reality we now find ourselves in, but we can’t afford to lose touch with each other and perhaps more importantly, ourselves. We can’t afford to sacrifice today and tomorrow’s opportunities because a virus just gave the world a horrible, epic swirlie and we’re glued to a device watching things fall apart. It’s time to break up with COVID-19. This is a defining moment in time, no doubt. How will this moment come to define you? Remember: we have work to do. We must get up every day, lead our teams, take care of our families, and provide services and support to communities and people who rely on us. (And hopefully, find toilet paper somewhere in between.) Need inspiration, or a reminder of why your work matters? Here’s a sample of the amazing things our clients have been up to – also known as why we get out of bed every day:

What are you up to? Let us know and we’ll give you a shout out, too. We’re in this together. Still in bed? Still feeling blue? Let’s throw all the damn clichés in here at once and snap the hell out of it: Stay positive. Breathe. Just keep swimming. Be in the moment. Enjoy the little things. Hug someone. Or tell someone you wish you could. Fix something you can fix. Clean something you can clean. Make a good meal. Then give it to someone else. Rethink your career. Consider your long-term plans for your business. (Make a long-term plan for your business.) Plant a garden. Plant a tree. Talk to your neighbors. Walk. Run. Cycle. Breathe again. Dream big. Innovate. Cogitate. Adapt. Improvise. Thrive. You’ve got this. Here are some of our favorite resources right now for moving on and moving out of crisis mode. Those of us who successfully break up with COVID-19 and end our internal toxic relationship with all that it brings will be better for it in the end. I know that sounds trite, naïve even. But it’s a hallmark of human experience that when disaster or tragedy strikes, we evolve in response. The exceptional among us turn horror into beauty, discord into order, and brokenness into wholeness. Join me. Say sayonara to this stupid virus. Become a stronger, better, more flexible, adaptable, sustainable person, and then empower and support those around you to do the same. I’m with you. Virtual Hugs, Chantal Get your financial house in order before you launch your next fundraising initiative!Nonprofits everywhere equate fundraising with tireless event planning, digital crowdfunding, relationship building, and writing grants. But we would offer that before your staff gets to work, the finance and development teams should have a solid understanding of the organization’s financial position. That information can help light a fire with the staff and board, shape your giving goals, and inform the messaging of your appeals.

So, we put together this handy checklist to help you get your financial house in order before you launch your next fundraising initiative. We’re pretty sure this is the first list of its kind – so enjoy and let us know how we can help! CLICK HERE to download the goods! Our Latest Picks for Nonprofit Tools, News & Resources!If you’re like us, your daily inbox is jam-packed with newsletters and educational opportunities from like-minded social impact leaders. These spectacular humans work around the clock to foster positive change in their communities. Then, somehow, find time to share their story with fellow nonprofit enthusiasts. We tip our hat to them!

Here are just a handful of our favorite nonprofit resources this month:

Thanks for stopping by to read our picks for top nonprofit news this month! If you’re interested in hearing more from us, subscribe to our newsletter today! About Blue Fox: Our team provides customized, boutique financial and back office services for social impact organizations. Services range from standard bookkeeping and payroll services, to coaching and consulting, to comprehensive virtual CFO services. Our mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email [email protected], and visit www.YourBlueFox.com. |

Our BlogWelcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy! Top ArticlesBack to Basics: How to Set Up Your Nonprofit Chart of Accounts

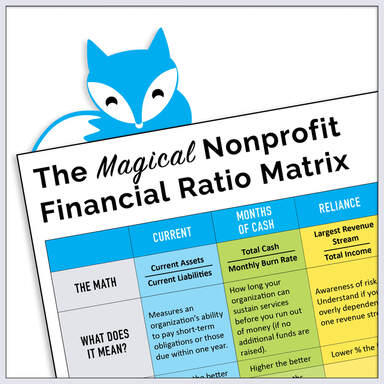

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits Behind the Scenes, New Client Onboarding Call When to Hire a Tax Professional - 10 Factors to Consider 40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know The Magical Nonprofit Financial Ratio Matrix 10 Reasons to Outsource Your Nonprofit Accounting How to Make Your Nonprofit Recession-Proof How to Engage Your Board of Directors in Financial Conversations QB Tip of the Month: How to Use Classes for Painless Grant Writing When to Hire an Accountant for Your Social Impact Org Are You Paying Too Much for Payroll? Company NewsBlue Fox Teams Up With Bloomerang to Develop Nonprofit Resources

Blue Fox Earns Better Business Bureau Accreditation Blue Fox Launches Protected By Logo Blue Fox - The Origin Story Categories

All

Archives

July 2024

|

||||||

BLUE FOX

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

Phone: (321) 233-3311, Email: [email protected]

Mailing Address: 2542 Woodfield Circle, Melbourne, FL 32904

Copyright © 2024 - All Rights Reserved

Holiday office closures: To give our employees time to unplug and refresh with their family and friends, the Blue Fox virtual office closes

for all federal holidays, the week of Thanksgiving, and the week between Christmas and New Year's Day.

RSS Feed

RSS Feed