Sheehan will speak on how to have meaningful financial conversations with a nonprofit board of directors.Melbourne, FL (December 19, 2019) – Chantal Sheehan, Founder and CEO of Blue Fox was recently named a speaker for NTEN’s 2020 Nonprofit Technology Conference (20NTC). The conference will take place March 24-26 at the Baltimore Convention Center in Maryland.

Dubbed by her clients as a nonprofit numbers guru, Sheehan will speak on how to have meaningful financial conversations with a nonprofit board of directors using the latest and greatest financial technology. Her presentation, 4 Strategies for Meaningful Money Conversations with Your Board, will introduce actionable strategies for nonprofit executives to use in the board room: financial dashboards, reporting tools and visual conversation starters. [Related: How to Wow at Your Next Board Meeting: 4 Tips for Meaningful Money Conversations] She explains, “Discussing financials with your board can be stressful. You’re often met with blank stares, irrelevant questions or surprise concerns. There has to be a better way. A better way to guide financial conversations. A better way to present the data. A better way to tap into the knowledge, experience and leadership that sits around your board room table. And, a better way to show your board that you are responsibly steering the ship.” With over 2,000 attendees, NTEN’s Nonprofit Technology Conference gives nonprofit leaders the opportunity to learn how technology can help them more efficiently serve their communities and create change. Organizers explain, “20NTC is designed to help you reinvigorate your work and bring that renewed passion back home.” Sheehan is a nonprofit organizational leadership expert and financial management coach with over 15 years executive-level experience across the private and public sectors. She guarantees 20NTC attendees a fast-paced session loaded with takeaways. As an avid blogger she spices up the topic of financial management in publications for Bill.com, Bloomerang, and Hive. Her company blog at www.yourbluefox.com features content aimed to educate and empower nonprofit and social enterprise professionals. From QuickBooks hacks to advice on how to talk finance with a board of directors, the Blue Fox blog has it all. A recovering nonprofit executive director herself, Sheehan started Blue Fox in 2015, and the company has doubled or tripled in size each year in response to high demand. For more information about Blue Fox call (321) 233-3311, email hello@yourbluefox.com, and visit www.yourbluefox.com. ### ABOUT BLUE FOX: Blue Fox provides customized financial and back office services for social impact organizations (nonprofits and social enterprises). Services range from standard bookkeeping and payroll services, to coaching and consulting, to full-blown virtual CFO services. The Blue Fox mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email hello@yourbluefox.com, and visit www.yourbluefox.com.

0 Comments

A Story About How We Serve Clients… When Bill.com calls to interview your CEO, you jump at the opportunity! Especially when they mention that your CEO is viewed as an industry-leading financial services provider and they want to share her expertise. And, now we’re blushing! READ THE FULL INTERVIEW HERE: Blue Fox, AI, and Maximizing Value for Accounting Clients Our CEO, Chantal Sheehan has first-hand experience with the challenges that nonprofit face and has structured Blue Fox services to support those unique challenges. In this interview, she explains how Blue Fox takes advantage of Bill.com’s AI-powered Intelligent Virtual Assistant to most efficiently serve clients. One of our favorite quotes from the interview is when our CEO, Chantal Sheehan said, “We focus on leveraging technology like AI so that we can apply human time where it counts for clients.” This is part of the Blue Fox philosophy and why we work so hard to provide the latest and greatest technology solutions for our clients. If your nonprofit or social enterprise is looking to professionalize your back office operations, give us a shout any time at (321) 233-3311 or hello@yourbluefox.com. OUR TOP PICKS: News & Resources for NonprofitsIf you’re like us, your daily inbox is jam-packed with newsletters and educational opportunities from like-minded social impact leaders. These spectacular humans work around the clock to foster positive change in their communities. Then, somehow, find time to share their story with fellow nonprofit enthusiasts. We tip our hat to them!

Here are just a handful of our favorite nonprofit resources this month:

Thanks for stopping by to read our picks for top nonprofit news this month! If you’re interested in hearing more from us, subscribe to our newsletter today! Why You Need It. How to Start It. Best Practices to Leverage It. WHY YOU NEED OPERATING RESERVES The news is full of warnings about the next economic downturn and possibly even a recession. Is your nonprofit ready? Is your financial house in order? Is your capital position and structure strong enough to withstand the ebbs and flows of our economic system? Recession aside, does your organization have enough moolah in reserves in case your air conditioner goes out (a catastrophic event in our sunny state of Florida)? And if your funds are used for an unexpected occurrence, will you still have the ability to deliver services in your community? This article is all about shoring up your ability to sustain operations when the unexpected happens (like when your office temp is 88 degrees) internally or externally. First off: do you have an operating reserves policy? If so, when is the last time your leadership team reviewed the policy? If it’s been a while read on as we guide you through the process of building an operating reserves policy, and the implementation and ongoing oversight of that policy. [ALSO READ: 5 Key Elements You Need in Your Operating Reserves Policy] According to Propel Nonprofits, “An operating reserve is an unrestricted fund balance set aside to stabilize a nonprofit’s finances by providing a cushion against unexpected events, losses of income, and large unbudgeted expenses.” Likewise, an operating reserve policy is meant to, “define and set goals for reserve funds, clearly describe authorization for use of reserves, and outline requirements for reporting and monitoring.” Our team at Blue Fox hears comments like this all the time, “Yes, we have a policy. I think my operations coordinator found a sample on some website. We presented it to our board a couple years ago and they approved it right away.” Oh boy do comments like that scare us! Look, it’s helpful that your nonprofit found a sample policy on the interwebs for free. But that’s all it is – a sample. A starting point. The very first step in the process. Your organization is not like others. Your cash flow is different. The diversity of your income varies. And your liquid assets are unlike that of the organization that wrote the sample. Your operating reserve policy should be as unique as your organization, plain and simple. So, let’s talk about the best practices for starting an operating reserves policy. And don’t hesitate to call on the Blue Fox team for advice and support along the way. We want all the organizations in our den to achieve fiscal sustainability and security. We can help assess your financial position today and provide some benchmarks to help you make decisions as you set up your operating reserves for tomorrow. HOW TO START AN OPERATING RESERVE As with most strategic decisions, the first step is to broach the conversation with your board and/or finance committee. Your treasurer, in particular, is a good first call. If you already have a policy in place, request a call to discuss revising/refinement of the policy. Most boards are eager to have this discussion because they understand the importance of a rainy-day fund. Once you have board buy-in the next step is to get your collective arms around how much you want to allocate to reserves. When times are good and the bank account is flush it can be tempting to allocate TOO much. (Especially if your organization suffered during the Great Recession.) On the flip side, some leaders skew to saving too little. We want to Goldilocks this thing and get it juuuust right. How? In order to determine the target reserve amount, you’ll want to take a look at your organization’s historic “burn rate” – i.e. how much you spend each month to keep the lights on, pay your staff, and, critically, deliver on your mission. How far back you should go to determine your burn rate can vary, but a good rule of thumb is to look at your average monthly spending for the last 12-24 months. Most accounting software should be able to produce a profit and loss report broken down by month for any given period. That’s the report you want to start with. As you review the data, you’ll next want to back out/offset your expenses by any unusual expenditures that occurred within your report time period. For example: if your organization went through a website redesign over a 6-month period in the last year and it cost $60k, you’re going to want to subtract $60k from the total expenses during that period. The idea here is to back out expenses that won’t be normal and recurring. The next step is to settle on how many months of expenses you want to (or are able to) set aside. Smaller organizations may be comfortable with 1-3 months, or even just enough to cover 1 pay period. Large organizations may take a more aggressive approach to saving and shoot for 12+ months of reserves. No more than 2 years of operating expenses should be held in reserve. We find the sweet spot for most nonprofits is 6-9 months of expenses. Once you have an amount in mind and the data to back it up, propose it to your board/treasurer/finance committee and discuss. With their blessing you can move forward with developing a policy. TIP: Don’t move any money or add “operating reserves” to your books as a line item until you have an operating reserve policy approved by the board! BEST PRACTICES TO LEVERAGE YOUR RESERVES: THE POLICY ITSELF IS THE KEY The first step in deriving leverage from your operating reserves is to structure a board approved operating reserve policy for its use. If you have a sample, great. If not, you can easily find one online through a search. We recommend the staff/leadership develop a policy draft and then pass it to the board/finance committee for review, feedback, and approval. We recommend that your policy should have these 5 key elements in order to be fully and appropriately leveraged!  Once your policy is drafted with solid answers to these questions, you’ll want to put it back in front of your finance committee/board for review and discussion. Policy approval should be unanimous. All board members should be on the same page with this strategic use of capital! If consensus is hard to find, keep working until you get there. What you don’t want is a dramatic, painful moment when you eventually have to use the funds. So bring everyone together on this from the get-go. When you get approval, go ahead and move that money (if you have it) or formalize your procedures for building the fund. Be sure to add the operating reserves to your accounting general ledger, too, so it’s clearly there for all to see. Operational touchstones like operating reserves aren’t sexy, we know. But there is no doubt that, as with our own individual savings accounts, we feel better when we know that emergency fund is there. We feel empowered to move ahead with our lives and financial decisions. We feel confident in our ability to deliver the critical services and support that we do to all our stakeholders and clients. If you need assistance starting or updating your operating reserves policy, Blue Fox is happy to consult with your leadership and we will even take those pesky tasks like bookkeeping, payroll and tax prep off your hands. We do that too! Give our friendly team a call any time at (321) 233-3311 or email hello@yourbluefox.com. Authors: Blue Fox CEO, Chantal Sheehan and Blue Fox Director of Marketing, Chelsea Clementi Nonprofits, take note. This is important! |

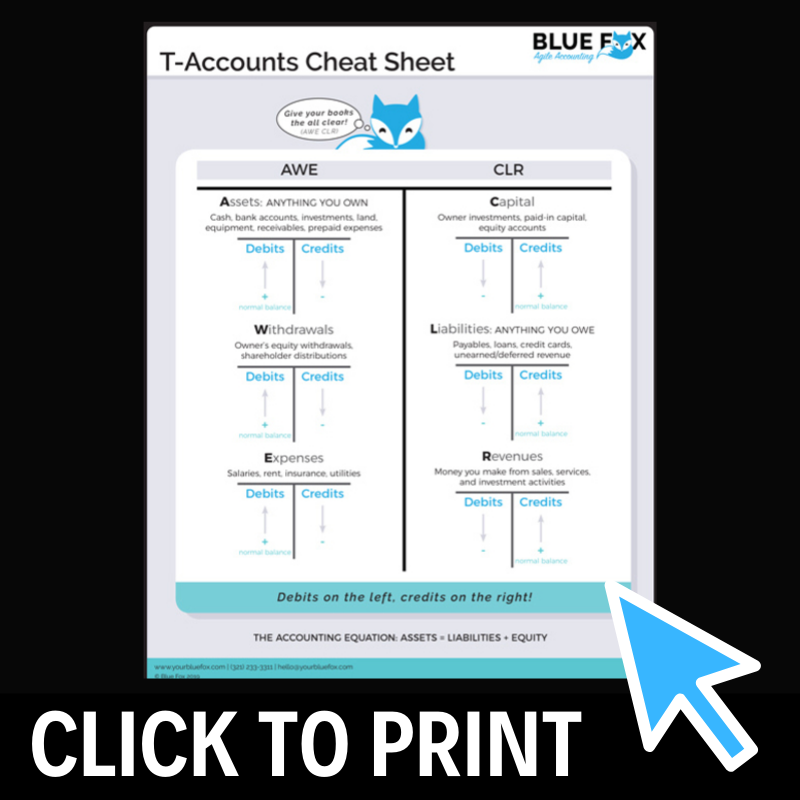

| T-Accounts are a visual representation of the fundamental concepts of double-entry accounting. If you're a bookkeeper or controller, you're no stranger to the double-entry system. But if you don't have formal accounting training, it can be tough to remember what goes where when you're making a journal entry adjustment to the books. Grab this quick cheat sheet for an easy 1-page guide to T-Accounts. Complete with a pneumonic helper, the more you refer to this in the short term, the more it will get locked into your brain! You won't be that bookkeeper referring to a cheat sheet multiple times a day after a few weeks of using this handy guide. |

There's an old accounting story that professors still tell to this day:

She locks the drawer every night before she leaves, and the other office staff gossip quietly every day about what's in the drawer. Chocolate? Can't be. It's not edible. A pet rock? Possibly. She's a little quirky. They speculate endlessly.

One day, the bookkeeper dies suddenly. The business owner gets her desk drawer keys from her family a few days later. The office gathers around as the big secret of the drawer is revealed. What's in it?

A simple piece of paper with the words "Accounting Bible" at the top. On the sheet is a strange coded set of words and symbols labeled "T-Accounts." The office staff stares in wonder, unable to make anything out of it. Then someone puts it back in the drawer and they walk away... Guess she really was an odd duck.

Get your very own Accounting Bible here ;)

[A Must Read for Nonprofits with Tuition Revenues]

If you’ve ever worked at a school (or been a parent who’s paid school fees) you understand that capturing the ins and outs of daily, weekly, monthly, or annual tuition can be confusing. Throw in scholarships, holidays, and seasonal breaks and you get accounting mayhem.

Last year, one of our clients with an adult day program rolled out a redesign of their tuition and fee structure. They moved from a pay-as-you go model to standardized fee rates, regular invoicing for families, and they also added a subsidy (i.e. scholarship) program to assist families who could not afford the full fare of the program.

Unfortunately, we were brought into the loop a little too late – and after the new process and payment structure was rolled out to the community. The result was one huge, hot mess for everyone involved – the staff, the Blue Fox team, and the participant families as well.

We’ll spare you the details, but as this past academic year wrapped up, the staff and Blue Fox were determined to work together to unpack the issues with the inaugural process and streamline the workflow. In the words of ME Parker, the Keeper of Books from the Blue Fox team assigned to this client, “The overall goal was to make this process not only much more simplified, but to make it a shared process… so everyone is working on the same page.”

It was paramount to Blue Fox that we have a collaborative and inclusive redesign of the workflow. Here’s how the process unfolded… it’s a roadmap anyone can use to work through a challenging workflow scenario.

Step 1. Gather data and analyze the challenges with the current process.

As soon as we realized that year 1 was a giant beast of a learning curve, we began to gather data on what was working and not working (for everyone involved). We made notes throughout the year on the issues we were having on the accounting side, and issues the staff were dealing with as they communicated with parents and managed their own recordkeeping related to the program.

Every time there was “an exception” made on the billing side, we kept a record of that in particular. Participants of the program have a level of intimacy with staff that, while a wonderful endorsement of the organization, created its own set of challenges as the staff tried to (understandably) bend to accommodate different needs and requests throughout the year. A beautiful intention that was followed by a brutal accounting process.

We also developed a spreadsheet to track gross fees and true subsidy amounts per participant, since this information was often incorrectly computed on site and incorrectly accounted for in the accounting software. At year end, we analyzed this information to ascertain the root causes of miscalculations and headaches, and we identified accounting and program policies and procedures that could be implemented to eliminate or avoid those accounting land mines.

Step 2. Determine recommendations and sketch out revamped process.

As this client’s virtual CFO, we were asked to take the lead and design the new workflow and identify the best technology to use in that workflow. We identified the core issues in play and made suggestions on how to prevent those issues going forward. We suggested things like:

- Standardize pay rates AND subsidy levels – a set system of tiered fees

- A change in invoicing frequency to support regular, recurring transactions

- Additional policies and procedures regarding those “exceptions” that came into play – credits for absences, for example

- We actually drafted several of these policies since this was new territory for the client

- Use online forms to automate the workflow around participant interest and registration

- Make changes to the accounts in use in QuickBooks (more on that in Step 4 below)

Step 3. Collect feedback from staff and TEST the new process.

After we settled on our recommendations, we presented them to the staff and asked for feedback. We had some very deep, meaningful conversations with the client to ensure that our ideas were aligned with their needs. The critiques we received allowed us to further tweak and refine the workflow.

Once our framework was set and agreed upon by all parties, we ran some tests of the new process. These tests revealed a few shortcomings in the revamped approach and gave us time to adjust and adapt the process prior to rollout.

I *cannot* overstate how important the testing component was – the Blue Fox team ran tests on our proposed systems based on the most complicated variables and scenarios that we had encountered in year 1. When we stumbled, we analyzed and clarified why and then refined the workflow (and/or our tools in use) further.

This is the kind of behind-the-scenes value add that we live to provide, and that really makes a difference to our clients.

Step 4. Implement technology solutions to streamline the workflow.

Most of our process improvements revolved around technology that would:

- Take the guesswork out of the workflow for the staff

- Eliminate (or at least significantly limit) staff improvisation or deviation from the process

- Create a paperless, but seamless, record for all involved – the family, the staff, and us

- Automate the workflow as much as possible

This laser focus on really leveraging the technology at our disposal was key. We all have tech in use at work – but does it really WORK for us? We were determined that should be the case.

So, we did things like:

- Drafted two online forms for the client to use and distribute (on their own website) detailing the new payment structure, rates, etc. When this form is completed, we get copies of the form emailed to us automatically.

- Created a spreadsheet for our own Blue Fox use to track gross fees, subsidies, and yes, the few exceptions here and there.

- Created two online forms that integrate with our internal project management software (Hive). These forms are used by staff when registration is complete and the forms immediately trigger new tasks for us. This allows us to stay on top of new registrations, invoicing, and troubleshooting in real-time rather than scramble to catch up with staff ad hoc.

- Refined the Chart of Accounts in QuickBooks and restricted the staff use to certain income lines only so we could run quick reports and spot anomalies/errors efficiently.

- Set up recurring invoices, sales receipts, and journal entries in QuickBooks to ensure real-time, accurate reporting on tuition and subsidies – a huge help to the client for grant writing, too!

Step 5. Communicate the changes with staff and stakeholders to ensure unity in approach.

The final and, arguably, most important step was to communicate with and educate staff on the new workflow. The executive director took the lead here as you might expect, and we were on hand to answer questions after the staff had a chance to digest the new workflow.

Did a few additional changes/needs arise after those conversations? You betcha. Were they as onerous or numerous as the prior year? Not by a longshot – at most, we have 5-10% of the curve balls we had last year.

And while the staff was busy taking these changes to their participants and other stakeholders, we were busy developing staff training materials to ensure accounting data entry accuracy throughout the year. These how-to docs sit on staff desks and guide them through every step of the payment receipt process.

You can’t argue with the results.

This consultation was a huge investment of Blue Fox time – candidly, we billed less than half the time we spent on this project. But for us, it was 100% worth it – this was a short-term project with long-term impact across the organization. And critically, efficiency has soared. It’s hard to estimate the amount of time saved this year versus last year, but we think our processing time is down by half or more.

The staff is no longer using paper forms to collect registrations, nor are they using disparate spreadsheets to track data and payments. Winning!!

We spotted the challenges, used our 20/20 hindsight to analyze them in granular detail, and then applied our macro-view foresight to innovate our way to success. Through sheer willpower and a won’t-quit-until-it’s-right mentality, we have iterated our pants off until, as ME says, “we assured consistency across the organization in complex scenarios… we brought fusion to a very disjointed process.”

Does your accountant do that? If not – you might want to email or call us at (321) 233-3311 to find out how we can help solve your back-office workflow problems. Go ahead. We have lots of free time now. ;)

Financial Management Education Specific to Nonprofits Coming Soon

The first publication, How to Wow at Your Next Board Meeting: 4 Tips for Meaningful Money Conversations, written by Blue Fox CEO Chantal Sheehan, is now available at www.bloomerang.co. It can also be accessed through Blue Fox’s blog at www.yourbluefox.com.

Blue Fox CEO, Chantal Sheehan said, “The majority of resources available to nonprofit leaders are dedicated to marketing and fundraising. And while those are important, it’s also vital for nonprofit executives to build financially sustainable organizations. There are not enough professional resources out there dedicated to nonprofit fiscal management. Blue Fox aims to change that as we share our expertise. We thank our partners at Bloomerang for giving us another platform.”

In addition to their guest editorial for Bloomerang, the Blue Fox team regularly publishes on their blog at www.yourbluefox.com/nonprofit-social-enterprise-financial-blog. Article topics range from the importance of kindness in leadership to QuickBooks tips specific to nonprofits to how to get a clean audit.

For more information about Blue Fox call (321) 233-3311, email hello@yourbluefox.com, and visit www.YourBlueFox.com.

###

ABOUT BLUE FOX: Blue Fox provides customized financial and back office services for social impact organizations (nonprofits and social enterprises). Services range from standard bookkeeping and payroll services, to coaching and consulting, to full-blown virtual CFO services. The Blue Fox mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information call (321) 233-3311, email hello@yourbluefox.com, and visit www.YourBlueFox.com.

Only 11% of Nonprofits Run Efficiently

One of the last nonprofits I consulted for used an Excel database to record checks received. A part-time recent college graduate was in charge of retrieving the checks and compiling the bank deposit.

Were there errors? Sometimes.

Did this staffer have questions? Often.

Did they have questions they never asked? Probably.

Was this process efficient? No!

Queue my broken record: There has to be a better way!

I’ve worked in the social impact sector most of my life. I think nonprofit professional do-gooders are highly innovative, intelligent and creative. Truth: we are scrappy geniuses. Put that on your resume!

So, why are some nonprofits still operating in the paper trail dark ages? Excuses of the past are no longer valid. Today’s back office technology is widely available, user-friendly, cost-effective and downright awesome! Fox-tastic, as we say at Blue Fox.

[Don’t Let FinTech Scare You – Our Top 4 Back Office Tech Tools]

Don’t feel bad if your back office is behind the times. You’re not alone. This Yale Insights article highlights a shocking fact, “According to NetChange’s long-running survey of technology use by nonprofits, only 11% view their organizations’ approaches to digital as highly effective.”

Imagine what your nonprofit could accomplish if your back office was humming away in a highly efficient manner?! Theoretically, you could do more than 89% of other nonprofits. Not that it’s a competition. ;)

Well, I take that back. I’m a competitive person, and let’s face it: all nonprofits are competing for market visibility and funding. These two functions directly affect your nonprofit’s ability to make a positive impact in your community.

Moral of the story: free up back office inefficiencies and go after what really matters.

So, how much time does technology and automation actually save you?

Giveeffect, a nonprofit software provider found that automation can save an organization over 30 hours per month. That’s huge! I say, take those 30 hours and throw them at mission related work.

Do I have you thinking yet?

It’s almost 2020. People thought cars would fly by now. Even more, people thought they would fly by now. (I was promised a jetpack!)

Technology advances are slow in some industries, but your nonprofit’s back office can and should be fully automated with today's proven tools. No excuses. Our team at Blue Fox uses the best-of-breed technology and we train our clients how to be FinTech rock stars.

We understand, change is hard. That’s why we encourage you to invite a professional nonprofit-focused accounting firm to help along the journey. Wink, wink – that’s us!

Make a virtual appointment with our CEO today. It’s time to get up to speed with the latest technology. Consultations are complimentary and often enlightening. Call (321) 233-3311 or email hello@yourbluefox.com.

Blue Fox will get you sorted!

Author: Chelsea Clementi, MBA, Director of Marketing & Business Development, Blue Fox

Resources:

Let's Upgrade Your Nonprofit Accounting Systems!

This article is for nonprofit organizations that may not have the latest and greatest financial technology. If it’s time to make a change, where do you start?

Read the full article for answers to these six questions:

- Why does my organization need accounting software?

- How flexible is my software budget?

- Will the software help me track my campaigns?

- What else should my accounting software help my nonprofit do?

- What if my nonprofit gets audited?

- Will we need to switch software again in a couple of years?

Our team at Blue Fox is always available to help you upgrade your systems. We bring you up to speed with software and processes that produce accurate and actionable financial data. And, that’s the kind of data that leads to insightful strategic decision making. Yes, we’re offering to make your life easier.

Let’s make your systems talk! Call us at (321) 233-3311, email hello@yourbluefox.com, or simply schedule your free consultation!

Our Blog

Welcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy!

Top Articles

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits

Behind the Scenes, New Client Onboarding Call

When to Hire a Tax Professional - 10 Factors to Consider

40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members

Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients

Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know

The Magical Nonprofit Financial Ratio Matrix

10 Reasons to Outsource Your Nonprofit Accounting

How to Make Your Nonprofit Recession-Proof

How to Engage Your Board of Directors in Financial Conversations

QB Tip of the Month: How to Use Classes for Painless Grant Writing

When to Hire an Accountant for Your Social Impact Org

Are You Paying Too Much for Payroll?

Company News

Blue Fox Earns Better Business Bureau Accreditation

Blue Fox Launches Protected By Logo

Blue Fox - The Origin Story

Categories

All

Blue Fox Foundation

Company News

For Individuals

For Nonprofits

For Social Enterprises

Press Announcements

Archives

June 2023

March 2023

January 2023

October 2022

September 2022

August 2022

July 2022

June 2022

May 2022

April 2022

March 2022

December 2021

November 2021

October 2021

September 2021

August 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

September 2019

August 2019

July 2019

June 2019

May 2019

April 2019

March 2019

February 2019

January 2019

November 2018

October 2018

September 2018

RSS Feed

RSS Feed