The Complete Checklist and Guide to a Seamless Payroll Provider Migration!This free resource >>> (The Savvy Switching Payroll Providers Checklist), will help your nonprofit or small business switch payroll companies without disruption to your back-office operations! You're welcome:) Is your nonprofit hiring a payroll company for the first time? Or maybe your social enterprise is switching to a new payroll service. |

| We're big fans of the ripple effect. Otherwise known as the:

It's the idea that one single act will cause continuous, cascading results. Most people think of the ripple effect on a flat surface. They picture rings spreading outward from a rock dropping into water. But think about what’s happening under the water too. The stone passes by wildlife and plant life and lands on the bottom, displacing sand. |

This Earth Day, imagine what we could achieve if every human on earth completed one act of goodness today. We would influence real positive change on our planet.

So, we challenge you to take action in whichever way feels best!

Pick up a stone, drop it into the water, and watch the ripples of care spread outward, upward, sideways, diagonal, and deep into humanity.

As you may know, conservation organizations hold a special place in our hearts. We highly recommend our clients if you’re looking for an organization to support this Earth Day.

- CREW Land & Water Trust

- Together Bay Area

- WattTime (their Founder’s recent Ted Talk will blow your mind)

Our team often says that we’re just humans serving humans. Today, let’s kick it up a notch and make it humans serving humanity.

Happy Earth Day 2022!

Here’s to you and the greater good!

Chantal

"DEI work is about recognizing that our unique individual circumstances factor into our ability to succeed." - Chantal Sheehan

Chamber Vice President of Business Development Mel Thomas said, “Chantal’s leadership style, professionalism, and operation of her organization made her an instant candidate to serve on the MRC’s DEI Committee. We are so honored that she not only accepted the invitation to serve but has been a force for driving those conversations and programs both internally and externally, as well as a financial supporter of our Professional Equity Sponsorship program for underserved business partners.”

The DEI Committee webpage also highlights investors and current committee members. For more information, visit www.melbourneregionalchamber.com/dei-task-force.

For more information about Blue Fox and Chantal Sheehan, visit www.yourbluefox.com.

###

ABOUT BLUE FOX: Blue Fox provides customized financial and back-office services for social impact organizations (nonprofits and social enterprises). The company’s services include bookkeeping, payroll, tax preparation, financial consulting, and comprehensive virtual CFO services. Blue Fox’s mission is to disrupt the traditional accounting model through technology, innovation, and a radically client-focused approach that truly empowers nonprofits and social enterprises. For more information, call (321) 233-3311, email hello@yourbluefox.com, and visit www.yourbluefox.com.

ABOUT MELBOURNE REGIONAL CHAMBER: For nearly 100 years, the Melbourne Regional Chamber has been the area’s driving force in creating an environment in which business thrives. The Chamber has grown from a small-town chamber into a regional powerhouse dedicated to developing and promoting the business interests of our partners. The Melbourne Regional Chamber is a representative, advocate, educator, and facilitator of connection dedicated to a thriving community. For more information, call (321)724-5400, or visit www.melbourneregionalchamber.com

Humans Serving Humans with Financial Peace of Mind

Recently, I listened in on a new client onboarding call.

I don't typically attend these calls. I'm the marketing person behind the scenes at Blue Fox (you know, the one showing up in your inbox with beautifully written newsletters).

But our CEO suggested that I listen to this one. She said I might be surprised by the conversation and to keep in mind that many of our clients come to us in the same state of mind.

Financial shop talk is what I thought I would hear.

Boy, was I wrong!

This is what surprised me:

"What are you looking to gain from our partnership?" we asked.

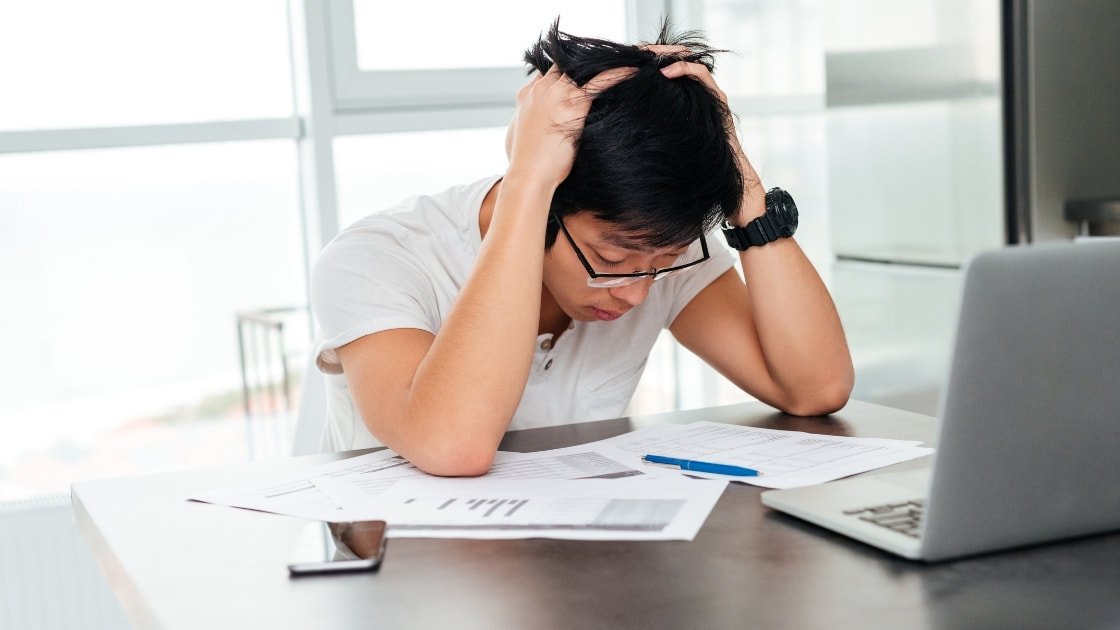

"I'm looking to gain stability," said our new client. "I've been working really hard to teach myself the finance side but realized I need to close the gap with your expertise. We could never trust our numbers. Numbers are facts, and we should be able to trust them to make decisions!"

These are some of the words our client shared with us. But it was the unspoken emotion behind their words that struck me.

They were frustrated, unsettled, timidly raising their hands. They knew it was time to ask for help. And now that help was there; all the emotions were coming to the surface.

It was almost like they had financial management PTSD.

What in the world happened to cause this level of stress?

It wasn't any ONE thing that was catastrophic. The simple answer is that our client is recovering from a not-so-good bookkeeper who made lots of mistakes and has since left the organization. And now, those mistakes are rearing their ugly head, causing a whole shitstorm of re-work, cash flow challenges, and tax compliance issues.

(That's why we always say you want a bad-ass bookkeeper, not a bad one!)

As the call went on, I could sense our client feeling more and more relieved in the spirit of our partnership.

Can you blame them?! They just gained a financial thought partner and another set of hands to oversee accounting data entry, management, and reporting.

Isn't it clear? What Blue Fox really delivers is peace of mind!

(And more time, consistency, financial access, process improvement, etc., etc., etc.)

And then the shop talk started, just as I suspected. The conversation was now all financials, processes, transfer of responsibility, data architecture, and high-level recommendations.

Here's a snapshot of EVERYTHING discussed (and then prioritized):

- Getting QuickBooks up to date

- Planning for equipment replacement

- Financial modeling

- Data analysis to streamline operations

- Expense allocation

- Data architecture

- Aligning systems

- Payroll accounting

- Tax and compliance notices

- A/R balances

- Point of sale systems

- Setting up a more natural Chart of Accounts

- QuickBooks tags

- QuickBooks projects

- Internal controls for receipts

- How to become a certified WOM (Women-Owned Business)

- Calculating overhead percentages for grants

- Allocating admin costs

My marketing mind was swimming at this point :) That's when I stopped paying attention (a symptom of being a creative person) and just started writing.

Nonprofit leaders need to know that they are not alone in feeling overwhelmed by financial management.

It's common for organizational leaders to have a background in service delivery/programs, marketing, or fundraising, not financial management and strategy. AND THAT'S OKAY!

That's why companies Blue Fox exist!

We set our clients up with the most efficient and tech-savvy financial processes to save them time and frustration. Then we provide access, information, and analysis to give clients the power to make strategic, data-driven decisions.

The onboarding call was almost over, so I zoned back in and heard our client say, “You have no idea the amount of confidence you're giving me! "It makes me sad for the stress we've experienced, but we're so happy we found Blue Fox to help us!"

Confidence.

Peace of Mind.

Kindness.

Understanding.

Patience.

We’re not your average accounting firm, are we?

Far from it!

Our CEO always says, “We’re just humans serving humans.”

An outsider might think that we’re just a bunch of bean counters performing accounting, payroll, and tax work for our clients. But we know it’s more than that.

When a nonprofit organization improves its financial stability, its leadership can take better care of staff members and deepen its ability to provide mission-driven services. Humans serving humans.

And that, my friends, is the ripple effect of care, kindness, and humanity.

I want to share a story with you, and I hope it will help you or someone you love one day.

Almost a year ago, I was diagnosed with an incurable, chronic inflammatory condition called endometriosis.

If you've never heard of endometriosis (or endo for short), I'm not surprised.

Most people haven't.

I really didn't understand what it was until I was diagnosed with it and forced to consult the interwebs. Those who suffer from endo experience a broad range of symptoms. That's part of what makes diagnosis tough.

Yet, "tough" is no excuse for how this disease rages on with little medical research or attention.

Endometriosis affects at least 1 in 10 women. (At least = probably more because it's not diagnosed correctly.) To put that in perspective:

There are few known therapies for treating endo. Its effects can be (and often are) debilitating.

Even more disturbing: On average a woman must see 8-10 DIFFERENT doctors/medical professionals before she is properly diagnosed with endo.

For me, that meant misdiagnoses started as a teenager and continued for two decades.

For me, that meant hearing (over and over and over) from doctors that my issues were simply "abnormal."

Or even worse, that my condition was just my own "bad luck."

But the truth is: I'm one of the lucky ones.

Many women die from endo complications.

Many women struggle with infertility due to endo.

Many women suffer with more pain than I ever had.

And many - SO many, TOO many - women don't have access to quality, unbiased healthcare.

The result: needless suffering.

In December 2021, I went for surgery so that my doctor could remove a life-threatening endometrial cyst from one of my ovaries in addition to performing other endo treatment. By all accounts, the surgery was successful, and I'm feeling better than I have in 10 years. The journey ahead is uncertain, but I'm optimistic about my physical health for the first time in a very long time.

A few of you know how scary this past year has been for me, both as a woman and as a business leader. I was terrified. From July to December last year, the reality of my situation sank in...

Was surgery really the best option? Or would our broken medical system fail me again?

How would I manage if I had to be out of the office for 4-8 weeks afterwards?

How would this disease affect my life and my relationships, both business and personal?

It was an incredibly stressful time. But less so because of many of you - my fellow Blue Fox friends, family, and teammates.

Our team and clients lifted me up, carried me and each other, and gave me the time I needed to heal.

What a gift. What a privilege.

Words cannot convey my gratitude, to my family and team especially.

I'm sharing this all with you because, as strong and as fierce as I'd like to think I am, this experience challenged me deeply on every level. I felt small, powerless, and uncertain throughout. And if I hadn't had any one of the support mechanisms I've mentioned, I might not have come out on the other side of this as well as I have.

Women often put their own care last.

That must stop.

We cannot show up for others properly if we cannot show up for ourselves first.

We'll share our learnings as we go, and hopefully inspire other businesses and leaders to step forward as advocates for the individual.

We're with you, as always, in your journey. And we hope you're with us, too.

Chantal

PS. March is not only Women's History Month, but it's also Endometriosis Awareness Month. We have a lot of work to do when it comes to women's health. I encourage you to donate, volunteer, and advocate for organizations doing work in this space. We must be the change we wish to see in the world! #breakthebias #endowarrior #womenshealth

Can you sense our distrust for big-box tax prep?

As you rip into the IRS envelope, all you can think about is how much you're going to owe. What went wrong with your tax return? And what do you do now?

If you use a big box tax service (you know, like the kind with a dude on the corner waving a sign to get you to walk in), there may not be anyone to help you now that you're in hot water. That is unless you paid for extra coverage to protect yourself. And why should you even have to pay for protection? We think companies should stand behind the work done by their employees. If they made a mistake, they should fix it – for free! (And btw: sometimes they charge for a protection fee and still won't make it right. That's the WORST.)

Can you sense our distrust for big-box tax prep?

Why do we feel that way?

Our team is appalled by the tax problems that new clients bring to us. So, we're putting on our hard hat and going to work for them to:

- Amend and correct previous year tax return filings (sometimes for bigger refunds)

- Assist with IRS nastygrams and correspondence to find a resolution

- Provide an understanding of payment options when large balances are due

- Help folks understand their tax situation in a big picture way

- Devise a plan to maximize tax savings and minimize an "OUCH" on future tax returns

We can't stress this enough: hiring a professional, experienced tax preparer is the best way to avoid that dreaded letter from the IRS.

This is especially true if you have a complicated tax situation: own your own business, have investment income or rental income, make more than $200K, got married, had a child, etc. If you're not sure whether your tax situation is complex or not, we wrote a list of factors to consider on this blog:

[How to Determine if You Have a Complicated Tax Situation.]

If you think there must be a better way, there is!

Meet the Blue Fox tax team at your service. We believe that people matter and highly-trained strategic thinkers should not be taken out of the tax preparation equation (pun intended). We spend a lot of time keeping up with changes in the tax code and making sure our clients leverage every opportunity for tax savings possible. Would you like us to do that for you?

If you'd like to chat with us, schedule your FREE Consultation by completing the form below that best describes your tax situation:

Individuals, 1040 + W-2

Self-Employed 1040 with Schedule C, A or E

Nonprofit Organizations, 990

Social Enterprise and For Profits, 1120, 1120S

We look forward to helping you!

Frontline charities are the ones that need your support the most right now!

If you’re reading this, thank you!

Our Ukrainian neighbors are in trouble, and we see you stepping up to help.

We’ll get right to the point: the frontline charities are the ones that need your support the most right now.

But before you get out your credit card, be aware that not all humanitarian organizations are created equal. Some do a better job of leveraging donations to maximize services and support. If you’re ready to give, we recommend the following nonprofits. (Note: we have no financial affiliation with these organizations and aren’t receiving any compensation in exchange for highlighting them.) These organizations will most efficiently transform your financial gifts into relief for the Ukrainian people.

- Doctors without Borders – “As the conflict escalates, Doctors Without Borders/Médecins Sans Frontières (MSF) is stepping up its medical humanitarian response to the deepening humanitarian crisis, both in Ukraine and in neighboring countries.”

- Global Giving – “Your donation to this fund will support Ukrainians in need, with a focus on the most vulnerable, including children.”

- International Rescue Committee – “The IRC is working with local partners to ensure that refugees find safety, shelter and that women and girls are protected.”

- International Federation of Red Cross and Red Crescent Societies – “The Swiss-based organization is supporting the work of the Ukrainian Red Cross in helping those impacted by the war.”

- UNICEF – “Escalating conflict in Ukraine is putting millions of children and their families in immediate danger. UNICEF has been working to keep children safe since this conflict began eight years ago.”

- Ukraine Red Cross - Emergency (redcrossredcrescent.org) – “The Ukrainian Red Cross is currently assisting people inside the country by aiding evacuations and providing shelter, food and basic necessities.”

- World Central Kitchen – “WCK is serving thousands of fresh meals to Ukrainian families fleeing home as well as those who remain in the country.”

- Voices of Children – “Working to support children across the country with emergency psychological assistance and assisting in the evacuation process.

Thank you for your kindness, love, and support for your global neighbors!

How to Determine if You Have a Complicated Tax Situation

Doing your own taxes that is… ;)

Listen, if you have a straight-forward tax situation (W2 only, no dependents, etc.), then DIY tax preparation software can work for you. As long as you have the time and good attention to detail.

That’s a matter of IF you want to do your own taxes.

Now, let’s talk about SHOULD you do your own taxes.

At what point in your life does it make sense to hire a tax professional (like us)?

As you venture through life, stuff happens. These life events sometimes make your tax situation more complicated and move you into a place where professional help is warranted.

We put together this comprehensive list to help provide clarity on when you should hire a tax professional.

Hire a Tax Professional If You...

- Always owe the IRS or state tax at tax time

- Own a business, or are self-employed

- Have income over $200,000 per year

- Had a major life event: change jobs, marry, divorce, have kids, adopt kids, buy or sell a home

- Have complicated investments, like investments in partnerships or trusts, or do a lot of stock trading

- Receive a large inheritance

- Buy energy efficient appliances, home improvements, or electric vehicles

- Borrow money from a retirement account

- Trade cryptocurrencies

- Have questions you can't answer

- Just want to relax and let someone take something off your plate :)

Beyond just tax preparation, the right tax professional will offer other, deeper benefits as your partner.

Tax Professionals Offer More Bang for Your Buck: Strategy and Assurance

- Year-round tax advice and tax planning

- Optimize your tax situation and lower your tax burden

- Make sure you're taking all the credits and deductions you qualify for

- Record keeping of complicated investments

- Assistance during an audit by the IRS

- Strategize on business structure to lower or avoid taxes over the long-term

- Help calculate quarterly tax payments to help with level out your cash flow

Would a tax professional provide a level of support that you need?

Did we mention that every Blue Fox client gets 1 hour of free tax planning pre-tax season (September or October) to strategize on maximizing their tax refund? This is particularly helpful for individuals who are self-employed.

If you and/or your family could use a tax professional this year, our team at Blue Fox is delighted to speak with you.

Schedule a free consultation using one of the buttons below that most closely represents your tax situation.

More about Blue Fox: In addition to tax services, Blue Fox provides social impact organizations (nonprofits and social enterprises) with back-office solutions including accounting, bookkeeping, payroll, HR, tax preparation, and financial coaching.

How to Handle Taxes For Your Side Hustle

Humans Doing Taxes? Yes, We're Old School!

Personalized Tax Services For Independent Contractors and Sole Proprietors

Defining OUR WHY: "After much discussion and brainstorming, we always came back to the same theme, YOU MATTER!"

We learned a lot moving through this process and thought you might find some use in a peek behind the curtain... so here's how it all unfolded. We kicked off strategic planning by watching Simon Sinek's Ted Talk, Start With Why.

Inspired, we set out to define OUR WHY.

Powerful, right?! And so true.

If you've ever talked to our CEO, Chantal Sheehan, or any one of our our foxtastic team members, then you already understand OUR WHY; there's no doubt we make you feel like YOU MATTER!. This theme has been at the core of Blue Fox from day one. It's only now that we recognize it's actually our explicit reason for being.

Chantal Explains:

/

- 1

- 2

- 3

- 4

- 5

Chantal Sheehan, Blue Fox Founder & CEO

/

- 1

- 2

- 3

- 4

- 5

Based on our strategery (that's a word right?), we identified three areas to focus on:

- Deepen Efficiency and Streamline Client Services

- Build Internal Capacity

- Focus on Data-Driven Decisions

Were we lacking in any of these areas? Not entirely. But technology changes at such a rapid pace and we want to keep up. We need to make sure that we use the latest and greatest tools to serve our clients with our best of breed approach. Our systems should talk to each other like old friends. Our exact processes must be defined, documented, and streamlined constantly. Our team must continue to develop their expertise in both accounting and technology. And, as we advise our clients, we must use data to make decisions.

This felt like a list we could rally behind. And so we did, making huge strategic advancements in just a few months.

How We Got It Done

Have you heard of the 12 Week Year?

It's a book, by Brian P. Morgan and Michael Lennington that promises to help you get more done in 12 weeks than most people get done in 12 months. Essentially, the theory is that if you block out time (literally - on the calendar) each week dedicated to your big goals, you'll actually make progress toward or achieve them in less time.

Naturally, our team of overachieving accounting gurus said, "We're in!" We worked together to map out 12 weeks of tasks, and each team member worked with an accountability buddy to get the job done.

The Results

After a quarter year of intense focus on our strategic goals, we made major improvements to our internal structure and our ability to best serve our nonprofit, social enterprise, and tax clients.

Here's a sample of what we were able to achieve:

- Increased integration of accounting systems and tools

- Implementation of new sales and client service systems

- Identified Our Ideal Client and positioned services accordingly

- Further standardized and enhanced the client onboarding experience

- Implemented even more data security measures to protect clients

We are a company committed to excellence, growth, efficacy, and service to others (Read: Our 5 Pillars of Service). We serve our clients with best-in-class technology, high touch personal support, strategic insights and most of all respect and kindness.

If your organization is looking for this level of support in accounting, bookkeeping, payroll, tax, HR and/or financial consulting, we're your fox! Let's talk about your back office needs today!

5 New Year's Resolutions For Sustainable Nonprofits

3 Vital Resources for Nonprofit Start-Ups

How to Create a Fairly Meaningful Budget

5 Immediate Steps to Take When Your Organization Experiences a Data Breach, Bank Fraud

Free Download: Data Breach & Bank Fraud Protocol

Your palms start to sweat.

Panic sets in.

You just noticed that your organization's bank account is missing a huge sum of money. Money that took months or years to fundraise is simply gone. What do you do?!

In the digital age we live in today, bank account fraud is all too common. Hackers are increasingly sophisticated and aggressive in their cyber-attacks. What might start as a ‘simple’ looking scam email can easily turn into a devastating case of bank fraud over time.

If your company has experienced bank fraud, you know how quickly one fraudulent transaction can turn into dozens as your bank information is bought and sold across the dark web to bad actors around the world, threatening the livelihood of your organization in a matter of days.

If you are the victim of bank fraud, you MUST ACT QUICKLY to prevent a catastrophic turn of events for your cash on hand.

To help you do that, we’ve put together this recommended protocol for you based on our experiences and the expert advice of cyber-security specialists.

- Use bank-level encrypted software and systems that are actively defended from cyberattacks

- Never email sensitive information or forms

- Actively educate our team on cybersecurity and internet safety

If your organization could use assistance in your back office, reach out to our team of nonprofit gurus today! We cheerfully provide social good organizations with bookkeeping, accounting, payroll, tax preparation, CFO level support and financial consulting. Let our experts handle your back office tasks and hand-deliver strategic insights. We will give you more time in your day to focus on your mission, serve others and make our world a better place.

Why outsource?

Here are 10 reasons why it make sense now, more than ever!

2021 Nonprofit Data Breach Resource Round-up

Worried About Identity Theft? The IRS Recommends This...

Don't Ignore This Nonprofit Financial Management Advice From NTEN

Our Blog

Welcome to the Blue Fox Blog! A fairly entertaining source of info and news related to our company, nonprofits, social sector trends, and, of course, accounting. Enjoy!

Top Articles

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits

Behind the Scenes, New Client Onboarding Call

When to Hire a Tax Professional - 10 Factors to Consider

40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members

Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients

Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know

The Magical Nonprofit Financial Ratio Matrix

10 Reasons to Outsource Your Nonprofit Accounting

How to Make Your Nonprofit Recession-Proof

How to Engage Your Board of Directors in Financial Conversations

QB Tip of the Month: How to Use Classes for Painless Grant Writing

When to Hire an Accountant for Your Social Impact Org

Are You Paying Too Much for Payroll?

Company News

Blue Fox Earns Better Business Bureau Accreditation

Blue Fox Launches Protected By Logo

Blue Fox - The Origin Story

Categories

All

Blue Fox Foundation

Company News

For Individuals

For Nonprofits

For Social Enterprises

Press Announcements

Archives

June 2023

March 2023

January 2023

October 2022

September 2022

August 2022

July 2022

June 2022

May 2022

April 2022

March 2022

December 2021

November 2021

October 2021

September 2021

August 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

September 2019

August 2019

July 2019

June 2019

May 2019

April 2019

March 2019

February 2019

January 2019

November 2018

October 2018

September 2018

RSS Feed

RSS Feed