Nonprofit Social Enterprise Financial Blog

Our Most Popular Posts:

Back to Basics: How to Set Up Your Nonprofit Chart of Accounts

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits

Behind the Scenes, New Client Onboarding Call

When to Hire a Tax Professional - 10 Factors to Consider

40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members

Why Outsource Your Nonprofit Accounting to Blue Fox? Ask One of Our Newest Clients

Client CASE STUDY: One of The Most Financially Sustainable Nonprofit Orgs We Know

The Magical Nonprofit Financial Ratio Matrix

10 Reasons to Outsource Your Nonprofit Accounting

How to Make Your Nonprofit Recession-Proof

How to Engage Your Board of Directors in Financial Conversations

QB Tip of the Month: How to Use Classes for Painless Grant Writing

Search the blog:

You’re Doing Great Things. Don’t Let a Workers’ Comp Audit Be Your Weak Link.

Let’s get real. You didn’t launch a nonprofit or become a B Corp to drown in insurance code spreadsheets or argue about whether your outreach coordinator is “clerical” or “field.” But workers’ comp mistakes can cost you thousands.

Hard Truths and Hope: When the Helpers Need Help

If you're reading this feeling exhausted, questioning whether you can sustain another quarter of "doing more with less," or wondering if anyone truly understands the weight you're carrying—you're not alone.

Productivity Hack: Focus Fridays for the Win!

At Blue Fox, we believe time is one of our most valuable assets—and when protected, it can be a powerful driver of innovation, clarity, and meaningful progress. That’s why we created Focus Fridays: a dedicated space on our weekly calendar to unplug from distractions and plug into deep, purposeful work. We rolled it out in 2021 and it's been a gamechanger for us!

BOI Reporting: Your Guide to Yet Another Fun Federal Filing Requirement

Here’s what you need to know about beneficial ownership information reporting.

** This post is historical only. After an extensive legal battle, the BOI filing requirement has been suspended for most companies in the United States.

'Tis the Season... to Get Your Tax Act Together!

As we wrap up another year (and our holiday presents!), we're here to help you put a bow on your 2024 finances. Pour yourself some hot cocoa, and let's dive into some timely tips and updates.

When Disaster Strikes

We're often asked by our caring clients, "What can we do to help?"

In the wake of Hurricane Ian in 2022, we put together a resource list of supporting organizations that were on deck to help. This week, we felt called to do the same in the terrible aftermath of Hurricane Helene.

Press Release - Blue Fox Top 50 Practice

Blue Fox was recently named a 2024 Top 50 Accounting Services Practice by Woodard, one of the nation's largest consortium of accounting firms.

A Personal Note from Our Accounting Team – This is What Inspires Us

Sometimes, we get wrapped up in the “accounting” part of our jobs. We forget that our work enables our clients to maximize their impact. Our clients are change-makers for good.

Our team recently visited Southwest Florida for our 2023 spring staff retreat. The trip was the perfect opportunity to be reminded how our accounting work makes a difference.

Blue Fox CEO Chantal Sheehan Joins Equality Florida’s Equality Means Business Advisory Council

Our team at Blue Fox is proud to announce that our CEO, Chantal Sheehan, is now one of the 150+ Florida business members of Equality Florida’s Equality Means Business Advisory Council.

CRITICAL INFO REGARDING BANKING RISKS

An Update on Silicon Valley Bank: Steps you can take to protect your business in this environment. Even if you did not bank with SVB, here are some general best practices to avoid being negatively impacted by a bank failure or other adverse financial situation.

Free Download: Schedule C Excel Worksheet for Sole Proprietors

Sole proprietors: get out your shoebox of 2022 receipts and let’s get organized. Our team at Blue Fox created this handy Schedule C Worksheet for your profit or loss record-keeping pleasure.

Biden-Harris Student Debt Relief Update – What You Need to Know

On Monday, October 17th the U.S. Department of Education (DOE) opened the application for the Biden-Harris Administration Student Debt Relief Plan. The application will be open through December 31, 2023. According to the DOE, "The Student Debt Releif Plan is It’s a program that provides eligible borrowers with full or partial discharge of loans up to $20,000 to Federal Pell Grant recipients and up to $10,000 to non-Pell Grant recipients.

Resources to Help Those Impacted By Hurricane Ian

Though the Blue Fox Den is virtual, Florida is our home state. Southwest Florida (SWFL) in particular holds a special place in our hearts - it’s where we got our start, served our first clients, and hired our first team members. The devastation we see from Hurricane Ian's destructive path is hard to process. The effects are unbelievably tragic, and it will be a long road back to anything remotely normal in Southwest Florida.

Back to Basics: How to Set Up Your Nonprofit Chart of Accounts

Introducing the Chart of Accounts (COA) - the foundational accounting tool every nonprofit leader needs to get right for maximum financial insight and awareness. It’s a critical element to your financial operations.

[EIDL Update] If your organization received a COVID Economic Injury Disaster Loan, read this important update!

Our Recommendation for EIDL Repayment: Pay off this loan as soon as comfortably possible for your organization to avoid a loan maturity balloon payment! At the least pay the accruing interest on a regular basis.

Our Client Asked for Advice on Covering Medical Travel and Abortion Travel

Our client asked for advice on covering medical travel and abortion travel. Here's our CEO's Actual Email Response:

How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits

The 4 most common payroll and tax compliance mistakes and how to avoid them.

There’s something stinky in the air lately. It smells like past payroll mistakes. And it takes a while to clean up. But it can be done!

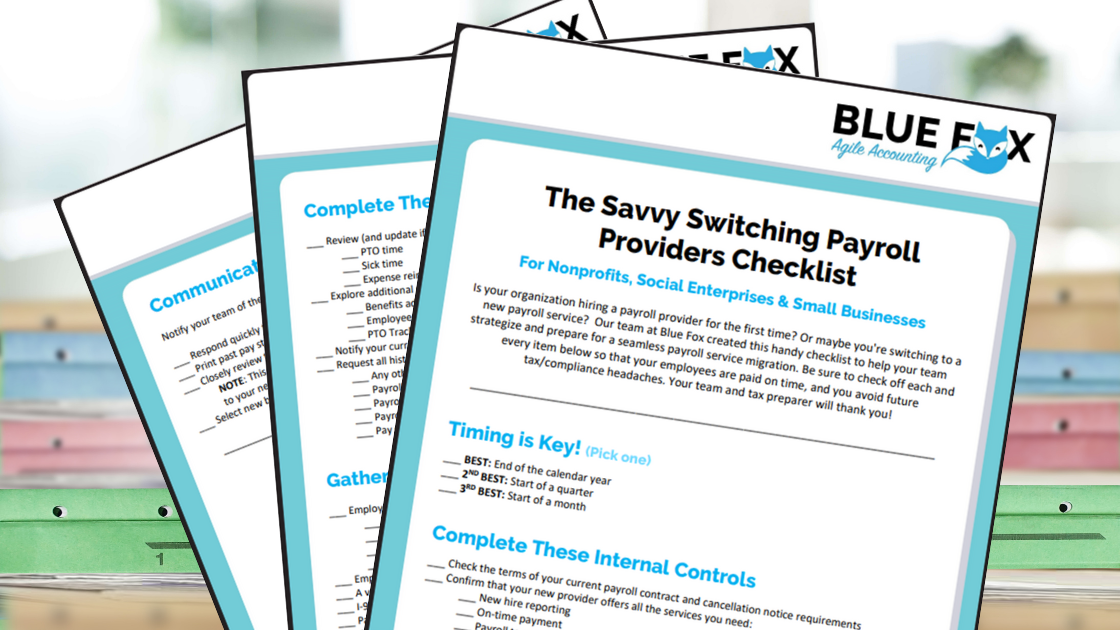

FREE DOWNLOAD: The Savvy Switching Payroll Providers Checklist

The complete checklist and guide to a seamless payroll provider migration!

Blog Archive

-

August 2025

- Aug 11, 2025 You’re Doing Great Things. Don’t Let a Workers’ Comp Audit Be Your Weak Link. Aug 11, 2025

-

July 2025

- Jul 10, 2025 Hard Truths and Hope: When the Helpers Need Help Jul 10, 2025

-

May 2025

- May 6, 2025 Productivity Hack: Focus Fridays for the Win! May 6, 2025

-

February 2025

- Feb 1, 2025 BOI Reporting: Your Guide to Yet Another Fun Federal Filing Requirement Feb 1, 2025

-

December 2024

- Dec 2, 2024 'Tis the Season... to Get Your Tax Act Together! Dec 2, 2024

-

October 2024

- Oct 10, 2024 When Disaster Strikes Oct 10, 2024

-

July 2024

- Jul 1, 2024 Press Release - Blue Fox Top 50 Practice Jul 1, 2024

-

June 2023

- Jun 18, 2023 A Personal Note from Our Accounting Team – This is What Inspires Us Jun 18, 2023

- Jun 8, 2023 Blue Fox CEO Chantal Sheehan Joins Equality Florida’s Equality Means Business Advisory Council Jun 8, 2023

-

March 2023

- Mar 12, 2023 CRITICAL INFO REGARDING BANKING RISKS Mar 12, 2023

-

January 2023

- Jan 9, 2023 Free Download: Schedule C Excel Worksheet for Sole Proprietors Jan 9, 2023

-

October 2022

- Oct 21, 2022 Biden-Harris Student Debt Relief Update – What You Need to Know Oct 21, 2022

-

September 2022

- Sep 30, 2022 Resources to Help Those Impacted By Hurricane Ian Sep 30, 2022

-

August 2022

- Aug 14, 2022 Back to Basics: How to Set Up Your Nonprofit Chart of Accounts Aug 14, 2022

-

July 2022

- Jul 10, 2022 [EIDL Update] If your organization received a COVID Economic Injury Disaster Loan, read this important update! Jul 10, 2022

- Jul 1, 2022 Our Client Asked for Advice on Covering Medical Travel and Abortion Travel Jul 1, 2022

-

June 2022

- Jun 28, 2022 How "Small" Payroll Mistakes Cause Multi-Year S#!t Storms for Nonprofits Jun 28, 2022

-

May 2022

- May 12, 2022 FREE DOWNLOAD: The Savvy Switching Payroll Providers Checklist May 12, 2022

-

April 2022

- Apr 26, 2022 We're Big Fans of the Ripple Effect! Apr 26, 2022

- Apr 13, 2022 Blue Fox CEO Joins the Melbourne Regional Chamber DEI Committee as Founding Member and Investor Apr 13, 2022

- Apr 11, 2022 Behind the Scenes - A Blue Fox Client Onboarding Call Apr 11, 2022

-

March 2022

- Mar 23, 2022 Blue Fox Founder & CEO, Chantal Sheehan Shares Her Personal Story to Raise Awareness for Endometriosis Month and Women's History Month Mar 23, 2022

- Mar 14, 2022 Don't Trust Blockheads with Complicated Tax Returns Mar 14, 2022

- Mar 10, 2022 Want to Support the Ukrainian People? Here are 8 Nonprofits That Are Providing Help Mar 10, 2022

-

December 2021

- Dec 2, 2021 When to Hire a Tax Professional Dec 2, 2021

-

November 2021

- Nov 19, 2021 Blue Fox's 2021 Strategic Planning and 12 Week Year Nov 19, 2021

- Nov 15, 2021 Data Breach Protocol Nov 15, 2021

- Nov 8, 2021 Free Download: Audit Checklist for Nonprofits Nov 8, 2021

- Nov 1, 2021 Blue Fox is Hiring: Our Ideal Client! Nov 1, 2021

-

October 2021

- Oct 25, 2021 2021 Nonprofit Data Breach Protocol Resource Round-up Oct 25, 2021

- Oct 1, 2021 40+ Ideas to Light a Fundraising Fire Under Your Nonprofit Board Members Oct 1, 2021

-

September 2021

- Sep 15, 2021 QuickBooks for Nonprofits PRO TIP: How to Use Classes for Painless Grant Writing Sep 15, 2021

- Sep 2, 2021 Virtual CFO Services Growing in Popularity with The Rise of Outsourced Accounting Services for Nonprofits Sep 2, 2021

-

August 2021

- Aug 4, 2021 How to Help Your Board From Getting Bored Aug 4, 2021

-

June 2021

- Jun 23, 2021 Nonprofit Startup Resource Round-up (June 2021) Jun 23, 2021

- Jun 21, 2021 Why Outsource to Blue Fox? Just Ask One of Our Newest Clients Jun 21, 2021

-

May 2021

- May 13, 2021 Nonprofit Volunteer Trends Round-up May 13, 2021

- May 3, 2021 Why Should My Nonprofit Outsource Its Accounting? May 3, 2021

-

April 2021

- Apr 26, 2021 Nonprofit Resource Round-up (April 2021) Apr 26, 2021

- Apr 14, 2021 The 2021 Child Tax Credit Advance - What Parents Need to Know Apr 14, 2021

-

March 2021

- Mar 23, 2021 Social Enterprise Resource Round-up (March 2021) Mar 23, 2021

- Mar 17, 2021 3 Financial Metrics to Watch Closely Each Month For Your Nonprofit Mar 17, 2021

- Mar 5, 2021 How Small Businesses Can Stay Afloat (and Grow) During Uncertainty Mar 5, 2021

-

February 2021

- Feb 25, 2021 Avalara: Your Trusted Advisor in Nonprofit Tax Compliance Feb 25, 2021

- Feb 24, 2021 Nonprofits, Have You Taken The Board Doctor’s Wellness Test? Feb 24, 2021

- Feb 23, 2021 Key Takeaways [and Great Resources] From QuickBooks Connect 2020 Conference Feb 23, 2021

- Feb 15, 2021 Nonprofit Resource Round-up (February 2021) Feb 15, 2021

- Feb 9, 2021 Love Is In The Air! Their Names are Finance and Fundraising Feb 9, 2021

- Feb 1, 2021 Tax-Free Is the Way to Be! The Consolidated Appropriations Act, 2021 Extends Employment Tuition Repayment Assistance Through 2025 Feb 1, 2021

-

January 2021

- Jan 25, 2021 We’re Shocked: IRS Announces 2021 Key Filing Dates, Tax Season Starts February 12th Jan 25, 2021

- Jan 7, 2021 Chills, Thrills, and Dollar Bills, Part 2 Jan 7, 2021

- Jan 7, 2021 Chills, Thrills, and Dollar Bills, Part 1 Jan 7, 2021

- Jan 2, 2021 Key Takeaways From the Latest COVID-19 Relief Bill, Including PPP2 Jan 2, 2021

-

December 2020

- Dec 21, 2020 How to Handle Taxes For Your Side Hustle Dec 21, 2020

-

November 2020

- Nov 19, 2020 Founder's Note: Introducing Blue Fox's First Client Case Study [It's Truly Inspiring] Nov 19, 2020

- Nov 16, 2020 How to Create a Fairly Meaningful Budget for 2021 Nov 16, 2020

- Nov 12, 2020 Crazed & Confused Over PPP? You’re Not Alone Nov 12, 2020

- Nov 4, 2020 Nonprofits, Looking to Increase Giving This Year? Nov 4, 2020

-

October 2020

- Oct 27, 2020 The Woman Behind the Blue Fox Logo: An Interview with Juhli Greene Oct 27, 2020

- Oct 20, 2020 Personalized Tax Services for Independent Contractors and Sole Proprietors Oct 20, 2020

- Oct 16, 2020 A Few Thoughts From Our CEO, Chantal Oct 16, 2020

- Oct 13, 2020 Is it Time to Incorporate My Side Hustle? Let’s Crunch Those Numbers! Oct 13, 2020

-

August 2020

- Aug 31, 2020 PPP Loan Forgiveness Update Aug 31, 2020

- Aug 26, 2020 Blue Fox + Bill.com = Clean Audits & Happy Clients Aug 26, 2020

- Aug 17, 2020 Raise More Money - 4 Financial Secrets for Fundraisers Aug 17, 2020

- Aug 9, 2020 What Fuels Financial Sustainably? A Continuous Cycle of These 4 Elements Aug 9, 2020

-

July 2020

- Jul 23, 2020 The Magical Nonprofit Financial Ratio Matrix Jul 23, 2020

- Jul 14, 2020 Your Organization's Technology Needs Are Changing - How to Adapt Jul 14, 2020

-

June 2020

- Jun 25, 2020 Why It’s a No-brainer to Use Bill.com for International Payments: 4 Key Advantages Jun 25, 2020

-

May 2020

- May 22, 2020 Dear COVID-19, I’m Breaking Up With You May 22, 2020

- May 18, 2020 The latest Covid-19 Resources for Nonprofits May 18, 2020

- May 4, 2020 How Client Onboarding Works with Blue Fox: An Overview of our Philosophy, Team and Process May 4, 2020

-

April 2020

- Apr 6, 2020 4 Steps to Manage the Covid-19 Crisis at Your Nonprofit Organization Apr 6, 2020

-

March 2020

- Mar 23, 2020 10 Reasons to Outsource Your Nonprofit Accounting Mar 23, 2020

- Mar 4, 2020 Nonprofit Resource Round-up: All About Raising Money Mar 4, 2020

-

February 2020

- Feb 18, 2020 Social Enterprise Resource Round-up (February 2020) Feb 18, 2020

- Feb 3, 2020 Blue Fox's Ultimate Financial Checklist for Nonprofit Fundraisers Feb 3, 2020

- Feb 2, 2020 How Grow Your Financial Services Firm: Rebrand to Attract Target Clients Feb 2, 2020

-

January 2020

- Jan 27, 2020 Worried About Identify Theft? IRS Recommends This for Identity Theft Prevention: Taxpayers Should Register for an Identity Protection PIN Number Jan 27, 2020

- Jan 27, 2020 What's In Your Back Office? Jan 27, 2020

- Jan 21, 2020 3 Vital Resources for Nonprofit Start-Ups Jan 21, 2020

- Jan 2, 2020 Nonprofit Resource Round-up (January) Jan 2, 2020

-

December 2019

- Dec 23, 2019 2020 QB Payroll Deadlines to Remember Dec 23, 2019

- Dec 19, 2019 Blue Fox CEO Chantal Sheehan Set to Speak at NTEN's 2020 Nonprofit Technology Conference Dec 19, 2019

- Dec 12, 2019 When Bill.com Interviewed Our CEO, Chantal Sheehan Dec 12, 2019

- Dec 9, 2019 Nonprofit Resource Round-up (December) Dec 9, 2019

- Dec 1, 2019 How to Make Your Nonprofit Recession-Proof: Perfect Your Operating Reserves Policy Dec 1, 2019

-

November 2019

- Nov 21, 2019 What Nonprofits Need to Know About the New Overtime Ruling Nov 21, 2019

- Nov 14, 2019 Social Enterprise Resource Round-up Nov 14, 2019

- Nov 7, 2019 Blue Fox Holds Ribbon Cutting Ceremony at Melbourne Regional Chamber of Commerce Nov 7, 2019

-

October 2019

- Oct 20, 2019 Nonprofit Resource Round-up (October) Oct 20, 2019

- Oct 15, 2019 Double-entry Accounting Made Easy! Oct 15, 2019

- Oct 7, 2019 Blue Fox CEO, Chantal Sheehan Named As Keynote Speaker for Nonprofit Hub's Cause Camp 2020 Oct 7, 2019

-

September 2019

- Sep 27, 2019 Social Enterprise Resource Round-up (September) Sep 27, 2019

- Sep 23, 2019 How to Prepare Your Nonprofit for Giving Season - Free Ultimate Financial Checklist Sep 23, 2019

- Sep 23, 2019 5 Steps to Solving Complex Workflow Problems: How We Designed and Built a Smart Workflow for a Tuition-Based Client Sep 23, 2019

- Sep 11, 2019 The Hidden Cost of Wearing Too Many Hats Sep 11, 2019

- Sep 5, 2019 The Key to Workplace Success: Investments in Professional Development Sep 5, 2019

- Sep 4, 2019 Accounts Payable Made Easy, The Marriage of Bill.com and QBO – You Need Both Sep 4, 2019

-

August 2019

- Aug 14, 2019 Blue Fox Teams Up with Bloomerang to Develop Nonprofit Resources Aug 14, 2019

- Aug 11, 2019 Nonprofits - It’s Time to Automate Your Back Office! Aug 11, 2019

- Aug 5, 2019 Nonprofit Resource Round-up Aug 5, 2019

-

July 2019

- Jul 31, 2019 How to Engage Your Board of Directors in Financial Conversations Jul 31, 2019

- Jul 17, 2019 Our Favorite Mandela Quote, The Social Enterprise Movement & Their Harmonious Connection Jul 17, 2019

- Jul 3, 2019 How Kindness Leads to More Profit and Productivity Jul 3, 2019

- Jul 3, 2019 Social Enterprise Resource Round-up (July) Jul 3, 2019

- Jul 2, 2019 Don’t Ignore This Nonprofit Financial Management Advice From NTEN Jul 2, 2019

- Jul 1, 2019 Blue Fox Earns Better Business Bureau Accreditation Jul 1, 2019

-

June 2019

- Jun 19, 2019 Building Blocks for A More Just, Equitable, and Inclusive Work Environment Jun 19, 2019

- Jun 4, 2019 Nonprofit Resource Round-up (June 2019) Jun 4, 2019

-

May 2019

- May 30, 2019 Nonprofit Leaders – Talk Finance and Empower Your Staff May 30, 2019

- May 27, 2019 Our YouTube Channel: Take One May 27, 2019

- May 21, 2019 When to Hire an Accountant for Your Social Impact Organization May 21, 2019

-

April 2019

- Apr 23, 2019 Nonprofit Resource Round-up (April) Apr 23, 2019

- Apr 23, 2019 Social Enterprise Resource Round-up (May) Apr 23, 2019

- Apr 23, 2019 Why Outsource Your Accounting & Back Office? Because You’re a Changemaker, Not a Change Counter! Apr 23, 2019

- Apr 18, 2019 That Time I Went to Cause Camp Apr 18, 2019

- Apr 16, 2019 Impact Investments in Yourself [7 minute read] Apr 16, 2019

- Apr 11, 2019 “What I Learned at the Nonprofit Tech Conference” - Karen Govern Apr 11, 2019

- Apr 2, 2019 Words of Wisdom from Our Nonprofit Technology Conference Buddy Apr 2, 2019

- Apr 2, 2019 Are You Paying Too Much for Payroll? Apr 2, 2019

-

March 2019

- Mar 19, 2019 QuickBooks Online Is Implementing Usage Limits WHAT YOU NEED TO KNOW Mar 19, 2019

- Mar 19, 2019 What I Learned at #19NTC Mar 19, 2019

- Mar 14, 2019 Financial Dashboards – Capture Attention, Create Conversations, Drive Results! Mar 14, 2019

- Mar 5, 2019 Don’t Let FinTech Scare You! Mar 5, 2019

-

February 2019

- Feb 26, 2019 The Wonderful World of Micro-Donating! How Technology Met Fundraising, Had a Millennial Donor Baby, and Lived Happily Ever After Feb 26, 2019

- Feb 20, 2019 Humans Doing Taxes – Yes, We’re Old School! Feb 20, 2019

- Feb 12, 2019 70% of Americans Have Poor Financial Health: What You Can Do to Beat the Odds Feb 12, 2019

- Feb 4, 2019 BLUE FOX LAUNCHES PROTECTED BY LOGO A Symbol of Financial Stability and Credibility for Accounting Clients Feb 4, 2019

-

January 2019

- Jan 25, 2019 The Case for Kindness in Business Jan 25, 2019

- Jan 21, 2019 2019 Mileage Rates Announced Jan 21, 2019

- Jan 13, 2019 Meet Penny – Our Clever Blue Fox! Jan 13, 2019

- Jan 10, 2019 How Nonprofits Build Donor Trust: Be Transparent! Jan 10, 2019

- Jan 2, 2019 5 New Year’s Resolutions for Sustainable Nonprofits Jan 2, 2019

-

November 2018

- Nov 30, 2018 Earth Mother & Proud Tree Hugger: Why We’re on a Mission to Help Conservation Organizations Nov 30, 2018

- Nov 26, 2018 Money Matters - So Why Aren’t More Nonprofits Talking About It? Nov 26, 2018

-

October 2018

- Oct 31, 2018 5 Tips to Get You A Clean Audit Every Year Oct 31, 2018

-

September 2018

- Sep 9, 2018 Blue Fox - The Origin Story Sep 9, 2018

- Sep 3, 2018 Press Release - Rebranding Sep 3, 2018

![[EIDL Update] If your organization received a COVID Economic Injury Disaster Loan, read this important update!](https://images.squarespace-cdn.com/content/v1/68d57357cbda0329dd23fd5e/1761849916243-RDKPV9H5S7WUUP8W7PAN/copy-of-contractors-blog_orig.png)